Investment Outlook , Published Feb 18, 2020

Outline

Expansionary policies of Central Banks, rising geopolitical tensions and growing protectionism are factors that will affect the global economy and in turn impact India’s growth outlook in 2020. We are more sanguine about the prospects for Indian equities from a bottom up perspective.

Planning for the decade ahead

The 1920s were the decade of excess, followed by the 30s depression, 40s world war, 50s golden years, 60s social unrest, flower generation and Vietnam war, 70s oil crisis, 80s computer revolution, 90s internet, 2000s bubble and financial crisis, and the 2010s debt and quantitative easing.

As we enter a new decade, here is what we can assume with a fair degree of certainty. Expect it to look different! We have picked 5 areas which could lay the foundations for Megatrends this decade.

Role of Central Banks – Pied Piper of Capital

It would seem reasonable to suggest that we will witness the culmination of the great central banker quantitative easing experiment this decade. This could lead to unrest, disruption and inflationary acceleration; alternatively, central bankers could become heroes for good with universal basic income, leading to higher consumption, and economic growth. As we enter the 2020s, we can’t help but wonder if we are being collectively drawn by the irresistible pull of irrational behaviour, led by the pied piper at the central bank.

We’ve collectively assimilated negative interest rates into our vernacular, debated universal basic income, trillions in money creation, and equities are being purchased without consideration to valuation. We are now 12 years into a market distorted by QE and monetary experimentation.

Money supply and stock markets are correlated, and the entire rally is driven by the printing press fired by the Fed. For the Fed to be cutting rates and pumping liquidity with unemployment at a 50 year low and markets at highs, is one indication of the crazy times we have to endure. What continues to remain a worry are the unintended consequences of distortion. What keeps the Fed up at night is deflation, and the Japanification of the US economy. In a deflationary scenario, buyers will defer purchases in anticipation of lower prices. Inventories and excess capacity will rise, forcing prices lower, sparking a deflationary spiral.

With global GDP around $85 trillion, levered by a factor of some 3:1 on $260 trillion of public and private debt, the challenge will remain credibility – if governments are credible and deliver credible spending plans then global investors will buy in, else, the price of debt starts to rise.

Geopolitical Friction and Rise of Protectionism

Tensions between different trade blocs which include Europe, US, Middle East, China and Russia will continue to rise. China is likely to set its own economic sphere using Chinese tech and Chinese systems. Changing global supply chains will exacerbate tensions. The recent showdown between Iran and the US and the impact on oil supply could rile commodity markets.

Europe is likely to suffer as the EU structure is likely to fail to agree on key fiscal policy, support for struggling economies. The US political cycle could impact markets later this year.

For years, foreign policy was bipartisan and expanding trade was considered highly desirable. Now, globalists have been overcome by protectionists, as politicians have used voter dissatisfaction on rising income equality.

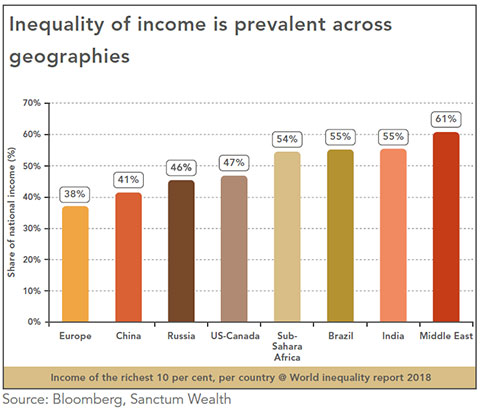

Rising Social and Economic Inequalities

As per report released by Oxfam, the world’s richest one percent have more than twice as much wealth as 6.9 billion people. The inequality situation is significantly worse in developing countries like India where the richest one per cent hold more than four-times the wealth held by 953 million people who make up for the bottom 70 percent of the country’s population. Rising inequality threatens the social fabric of the nation. Inequitable growth provides fuel for social unrest and rising crime.

Artificially low interest rates have not extended down to low-income individuals with poor credit. The huge number of people that fall into this category get no relief and low rates punish savers, further fueling inequality. Governments continue to favor trickle-down economics which has not worked. That inequality is the worst since 1928, is of limited consequence.

As corporations are getting more aware of their social responsibilities, we are also witnessing rise of impact investments and pooling of philanthropic capital to bring sustainable impact. However, this is only the tip of the iceberg and a lot more needs to be done.

Opportunities and disruptions: Two sides of Automation

Disruption is rampant. Automation will accelerate and exaggerate the massive deflationary impacts of technology. McKinsey estimates that up to 800 million jobs could be lost worldwide by the end of the decade as a result of technological progress. The wise amongst us are already preparing for the changing world. The fourth industrial revolution – automation, robotics, innovation in health care, deep tech – are the new opportunities. The innovation engine is still strong, despite WeWork and few other blips.

Investors can profit in the Decade of Transformation if they can identify and invest in secular winners in the context of a robust financial plan. We zero in on market segments where we see the greatest potential, in key areas of digital transformation. Data is the key input that will drive the digital transformation in the decade ahead.

With businesses around the world turning to 5G, AI, and cloud computing, the companies that provide these services and develop technologies related to them are likely, in our view, to enjoy increasing investor interest.

On the other hand dissatisfaction with big-tech, surveillance capitalism, and income inequality may spawn considerable voter pressure and regulatory backlash.

A growing chorus of businesses, lawmakers, and regulators are now calling for big tech companies to be broken up. By creating an effective and credible self-regulation framework, companies can react faster to the rapid pace of innovation that is undoubtedly going to continue to happen in the tech industry.

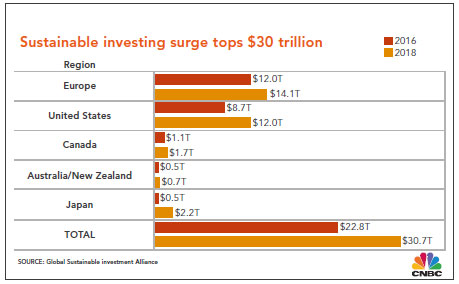

Global Warming and ESG Investments

ESG strategies in investing are gaining significance at a rapid clip globally driven both, by regulatory push as well as investor demand. In the beginning of 2018, $11.6 trillion of all professionally managed assets — $1 of every $4 invested in the US — were under ESG investment strategies. Companies that do not address sustainability risks and governance will face growing scepticism resulting in greater cost of capital. Studies have proven that ESG integration doesn’t detract value to shareholders in the short term while adding material value to stakeholders over the long term.

The ESG trend is gaining traction in India as well. As environment friendly processes/practices also become cost effective, adoption is gaining pace as seen in renewable energy, electric vehicles, etc. The governance part of ‘ESG’ is undoubtedly a significant criterion for equity as well as fixed income managers in their security selection.

Companies recognized for their governance practices attract premium to their peers.

India Outlook 2020

Domestic Growth

The most worrisome of all heading into 2020 is the disappearance of domestic growth. Reforms have delivered operational efficiency, but the golden goose has been wounded. Tax and spend policies rarely deliver the intended benefits. The albatross of unscrupulous practices and defaulting debts held back the economy and continues to do so.

India’s recovery looks to be like the proverbial unicorn, always creating hope but difficult to find. Hope stems from some of the steps taken by the central bank and the government. The central bank’s rate cuts should lead to lower lending rates. The government’s decision to infuse capital into public-sector banks and the central bank’s measures to revive non-deposit-taking financial companies should help strengthen the financial system.

The RBI’s transfer of surplus capital reserves to the government also creates more leeway to increase fiscal spending. The government lowered the corporate tax rate which is likely to boost private investment and has the potential to attract greater foreign investment over the next few years—just as the US-China trade war is prompting global manufacturers to rethink their supply chains.

In the more immediate term, good rainfall and government income support is expected to boost farmers’ income and drive rural consumption. As transmission of lower rates get efficient, borrowing rates for home loans and personal consumer loans will go down. These should support overall consumption.

Post-tax corporate profits are likely to be higher. Early numbers suggest some turnaround in the October-December quarter, largely because of a low base in the Oct 2018 quarter. A genuine recovery should start in 2020; however, the strength and amplitude of this recovery remains fairly difficult to predict. Unfortunately, inflation has reared its ugly head and overshot the RBI’s tolerance band. This does limit some of the maneuverability of the RBI and hence is important to watch the number.

Equities

Post the S&P’s best year since 1997, Gold’s best year since 2010 and a decade that belonged to the US, one would think the next decade belongs to EMs. Time will tell!

We live in a world where no price seems too expensive to own a great company. Extraordinary times lead to extraordinary behaviour and the most difficult thing to do is to pull away from the crowd, at the appropriate time. That time does not appear on the horizon currently. In the short-term, the bull market could easily continue higher.

Domestically as the economic growth got shrouded in uncertainty, the equity narrative shifted in favour of quality. Large cap indices are now at the most expensive levels of the decade. Value stocks are decimated but continue to act like falling knives.

While valuations aren’t a great market timing indicator, they do impact long-term returns and investment outcomes. Currently, at 30 times earnings and higher for most stocks investors own, valuations are elevated, which suggests that returns will have to be lead by other pockets of the markets. In the recent months the eye-popping valuations of large cap quality stocks finally seem to redirect some of the liquidity to mid-cap and non-index large cap stocks which could be the start of a de-polarization trend. We are circumspect in using the word ‘growth’ generously as the data to support the claim is yet to come through. It’s liquidity that’s in the driver’s seat. One should respect the momentum behind these moves for the foreseeable future but be mindful that liquidity can evaporate quickly.

Sanctum Equity PMS Strategies

Stock selection was the key determining factor that led to our portfolios outperforming and ending in the top rungs from a three-year CAGR perspective, and in the top performers last year. Usually, a liquidity driven broader rally blurs the line between the boys and men. With the economic backdrop, most of the returns may come via multiple expansion initially. Companies that disappoint in earnings get whipsawed and market reactions can get exaggerated.

In the summer of last year, a number of institutions were clamouring for mid and small caps. We faced pressure but chose to remain with large. Looking ahead, the market appears to be willing to reward mid caps and small caps, selectively. So adding incremental exposure to quality mid caps, or multi cap strategies, is our preferred factor positioning. The market for small caps is likely to be illiquid and possibly challenging but potentially rewarding. Large caps will continue to outperform in the current economic environment, and again we’ll caveat that by saying selectively.

Our Sanctum Indian Olympians strategy has delivered 20 percent CAGR and Sanctum Indian Titans 17 percent CAGR over three years. That suggests that even in challenging times, experienced portfolio managers will deliver returns investors can be happy with.

However, our experience of the past decade has demonstrated that the list of managers that can deliver outperformance is a fairly limited number.

Last year, we were optimists. We were advising investors to invest and saw a good year ahead. Today, the world is a bit more mixed and challenging. Risks in portfolios have risen dramatically today. More than ever, choices on investments and manager selection, product selection will determine outcomes.

Our advice remains simple: align with trusted, competent, experienced investment managers.

Fixed Income

As 2019 comes to a close, global fixed income investors are settling on a view that low to negative interest rates may be a structural condition for the foreseeable future. Global cues are a mixed bag, geopolitical conditions have deteriorated at the start of the new year, but offset by progress on trade conflict. Food inflation has been inching up globally but the outbreak of the Wuhan virus could impact China’s growth thereby slowing demand and reshaping some of the supply chains.

In India, we think the structural trend is toward low rates, but hurdles remain in achieving that objective. The central bank will have to pause on its path of fiscal prudence to nurture greenshoots of growth putting a floor to rates in the immediate term. Risks to duration exposure therefore remain tangible, leaving us shunning duration bets.

The credit crisis that has plagued the economy, the financial sector, and sections of the corporate sector appears to have stabilized, but confidence remains fragile. The PSU sector remains vulnerable and despite massive capital infusions, the core rot in the system remains unaddressed and will continue to weigh. That being said, the worst of the NPA loans is behind us, and things are likely to get slowly better.

We have already played the spread compression of AAA/AA+ over g-sec and credit risk continues to appear somewhat risky. This is a playground for patient capital. Fragile confidence tends to exaggerate reactions and that in turn creates mispriced opportunities. We continue to look for such mispriced opportunities while otherwise holding a defensive, short term portfolio. Should economic green shoots take hold, we’d look to increase credit risk exposure selectively.

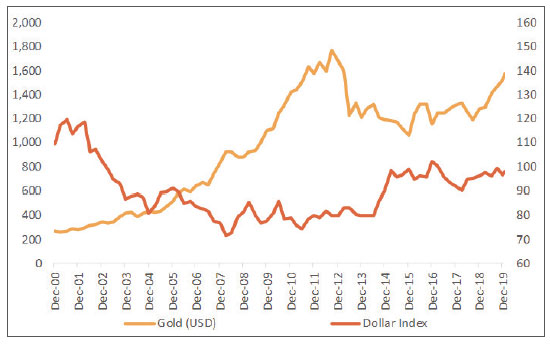

Gold

Gold has broken into an uptrend in the past few months. Gold has historically tended to outperform during periods with higher inflation and low to negative real interest rates. Gold also tends to outperform during periods of currency debasement. Both conditions are in place.

However, none of these relationships, including crude, dollar and copper, are reliable and consistent. We have consistently maintained that Gold deserves an allocation in investor portfolios. As a percentage of total portfolio, our weight in Gold generally is at a 10 percent strategic allocation.

It’s difficult to foretell whether this move in Gold will extend further, however, the conditions for a flight to safety and move higher do exist. Gold’s attractiveness rises as we consider that most investors will not be satisfied with expected returns in risk free bonds. However, it’s difficult to view a scenario where gold and equities co-exist. The recent move is purely as a hedge building exercise by countries and large institutions.

Gold has significantly outperformed the Dollar

Currency

A weaker Dollar seems to be the consensus view. High interest rates, risk aversion stemming from the downturn in global trade, and support from earnings repatriation have supported the USD the past few years. However, our expectation is that the US growth will be lower looking ahead. US growth and interest rates will be closer to those elsewhere in the developed world, and recognition seems to be building towards emerging markets growth.

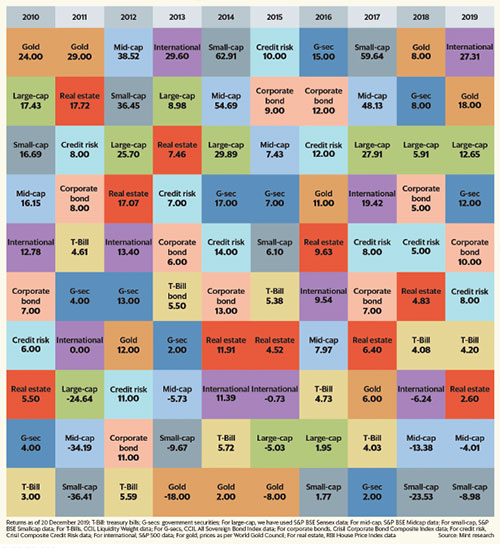

Asset Allocation Is Key and Will Remain So

The 2010s were a challenging decade, but stellar returns were on offer. Looking back, there was genuine fear about the world falling apart, the Euro coming apart, the US, China, Greece, Italy facing their own issues. Yet the decade turned out to be very profitable for managers and investors that allocated appropriately. Tactical adjustments will remain key in the years to come.

Asset allocation ruled the last decade

The asset allocation quilt

The table ranks 10 asset classes in order of their return performance-from the highest to lowest-for each calendar year in the 10-year period from 2010-2019. For example, Gold gave a return of 24 percent in 2010, and large-caps came in second with 17.43 percent in the same year. The absence of any pattern in the returns of asset classes from one year to the next reinforces the importance of asset allocation to build a portfolio against trying to consistently predict the next winning asset class. A diversified portfolio of stocks, bonds and physical assets is key to steering through every market condition. Such a portfolio may not deliver the highest return in any given year but will perform competitively across market cycles.

About Prateek Pant

Prateek Pant is part of the Founding Management Team at Sanctum wealth Management and oversees the India product platform to deliver client solutions in Investments, Wealth Planning and Real Estate. He has over 23 years of experience in the Banking and Financial Services sector in India and the Middle East.

Download Investment Outlook 2020

Download Investment Outlook 2019

Download Investment Outlook 2018

Download Investment Outlook 2017

Investment Outlook 2020