Investment Outlook – Trend 4 , Published Mar 16, 2017

Commodities exited a painful bout of demand and supply rationalisation last year. Going forward, China and Trump’s fiscal stimulus will remain drivers of incremental demand.

The Boom (2002–2008)

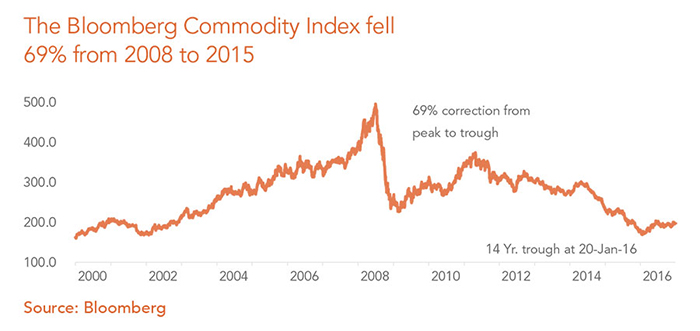

Commodity cycles generally peak when high prices foster greater production and lower demand, eventually leading to a surplus that puts downward pressure on prices. The 2002-08 cycle was driven by China’s aggressive infrastructure buildout and commodity acquisition spree in the2000s. Following classic intermarket relationships, the commodity cycle peaked in early 2008. Rapid growth in emerging markets such as India added further impetus to the boom.

The Bust (2008–2016)

Commodity cycles bottom when lower prices make producing less profitable, eventually resulting in supply reductions, which brings about a rebalancing in supply and demand, and eventually drives prices higher. Producers of commodities rushed to add new capacity and new sources of supply entered the market towards the end of the decade as the world entered a global recession.

The new supply, along with crashing demand, led to a crash in commodity prices from 2008 to 2015.

OPEC’s decision to slash oil prices further exacerbated the situation for other commodity markets. Prices of most commodities fell below the threshold at which producers could operate profitably in 2016, leading to miners, energy producers, farmers and ranchers to curb production.

The Bottom

Supply and demand have been rebalancing across virtually every commodity sector since 2014.

Commodity spot prices got to under historical production costs in 2016 for approximately 70% of the commodity complex.

The market has achieved a rebalance and a price floor appears to be in place. The prospect of significant stimulus by the Trump administration is the add-on demand side catalyst that we believe heralds a probable turn in the commodity cycle. Commodities are classically cyclical in nature and cycles can persist for years.

A number of factors apart from the U.S. fiscal push have acted to accelerate the recovery. China’s massive stimulus program, OPEC’s supply cut, Beijing’s new plans, the One Belt One Road initiative, the Asian Infrastructure Investment Bank, the BRICS New Development Bank and the nascent focus of India and emerging economies on modernisation are likely to spread economic development in many regions.

The Degree of Divergence from Stocks and Bonds is Highly Unusual

The fundamental catalysts for a sustained recovery are brewing. Recoveries in fundamentals have coincided with handsome returns. The degree of commodity underperformance over the past decade is startling. Commodities were two standard deviations from their historical averages on the ratio of monthly commodity returns relative to stocks and bonds last year. While prices have rallied, the current market environment offers a value-driven entry point for commodities, if the demand drivers in the U.S., China & EM come through.

Vedanta Plans $5.9 Billion India Spend

If one needs further evidence that prospects are picking up, look no further than billionaire Anil Agarwal’s plans to invest $5.9 billion over the next three years across his oil production and metal businesses in India. The world of commodities may be on an upswing and this could be the start of a cycle. Prospects for mining companies look bright for a number of reasons. The agricultural commodities complex is also on an upswing. Domestic demand drivers remain on an upswing as well, with a government focused on infrastructural spending and development.

Download ReportInvestment Outlook 2017