Indian investors typically invest most of their money in India, thus missing out on the opportunity to invest in global leaders, diversify across geography, improve return potential, and stabilize portfolio returns. Global investing is now easier than ever. This series in 5 parts will help you understand some of the benefits of global investing and the various options available to you.

Watch this space as we delve deeper into themes like ‘Investing in Overseas Real Estate Assets’ and ‘Investments for Citizenship’

1. Missing out on Opportunity – By investing only in India, investors are missing out on opportunities that are available elsewhere in the world.

a) India vs Global Equity Market Cap – India comprises only about 3% of global stock market cap.

b) India vs Global GDP – Even in terms of GDP, India comprises only 3% of global GDP. Adjusted for purchasing power parity, India is only 7.7% of global GDP at PPP.

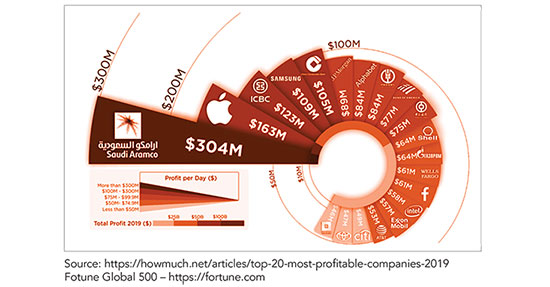

c) Missing out on opportunity to invest in global leaders like – Google, Microsoft, Facebook, Amazon, Tesla, Alibaba, Tencent, Samsung, LG, Honda, Toyota, Saudi Aramco etc.

Only 6 of the Fortune 500 companies by revenues have their headquarters in India and none of the world’s top 20 most profitable companies are from India.

d) Each country has its own strength – The US is known for innovation, Germany for engineering, China for low cost manufacturing, India for low cost services. Having a global portfolio allows once to capture strengths of each geography.

2. Diversification – Investment in only one geography exposes investors to country specific risk. Political or economic instability in that country can significantly impact portfolios.

a) Correlation – Historically, global markets have had low correlation with each other. Hence, returns across geographies can stabilize portfolio returns

b) Winners Rotate – No country has consistently outperformed every year.

3. Currency depreciation can add to returns – Over the last 10 years INR has depreciated by 4.7% annually against the USD. Hence, any foreign investment would automatically grow by 4.7% annually in local currency terms.

4. Global Wealth Plan – As the world is getting more interconnected a lot of Indians have foreign currency expenses like children’s foreign education, holiday abroad, etc. As currency depreciation adds value to foreign currency assets when converted to local currency, it would eat into the value of local currency assets when converted to meet foreign currency expenses. Every year local currency investments need to grow by 4.7% to make up for INR depreciation.

Liberalized Remittance Scheme (LRS) of the Reserve Bank of India (RBI) allows resident individuals to remit a certain amount of money during a financial year to another country for investment and expenditure.

Apart from this, the remitted amount can also be invested in shares, debt instruments, and immovable properties overseas. Individuals can also open, maintain and hold foreign currency accounts with banks outside India for carrying out transactions permitted under this scheme.

Eligible Investors: All resident individuals, including minors, can freely remit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both.

Non-Eligible Investors: The scheme is not available to corporations, partnership firms, Hindu Undivided Family (HUF), Trusts etc.

Sanctum Offering for LRS Investments:

To enable you to take advantage of this opportunity and to provide a one-stop solution, we have tied up with Avestar Capital. Avestar provides end to end LRS investment solutions like account opening, investment solutions based on the risk appetite of the clients, tax advisory at the end of the financial year, etc. Avestar manages around USD 1.2 Billion under discretionary and non-discretionary mandates and has offices in New York, San Francisco, and Mumbai. Some of the key aspects of the proposition are listed below:

Services offered:

The products on offer include direct trading of stocks, bonds, ETFs, MFs, Real Estate etc.

Investment migration opens a world of opportunity from diversification of your assets to providing you with greater freedom of movement and a better lifestyle as well reassurance in times of crisis, however it is important to understand your objective to ascertain the suitability of a residence or citizenship program.

No doubt the world has shrunk to a global village, but the pandemic has more compellingly unveiled the global landscape for wealthy individuals to re-etch their addresses on the world canvas to be called ‘home’.

In the elite world of investment migration, the ultra-rich individuals are closely looking at Citizenship-by-Investment (CBI) and Residence-by-Investment (RBI) programs, also popularly known as “golden visas” that provide citizenship or residency in exchange for investment in the host country. These programs not only help you to diversify your portfolios but also enable you to enjoy the benefits of citizenship and/or residency.

Investment migration programs offer residence or citizenship in exchange for substantial investment in a country’s economy, usually in the form of real estate, creation of local jobs, infrastructure, donation or government bonds.

CBI programs can confer on you the same rights as ordinary citizens whereby you are provided with the right to vote, usually the ability to pass the citizenship to future generations and international visa-free travel, subject to the passport strength. The merit of CBI is that it bypasses the traditional route of naturalisation whereby you and your family have to relocate to another country to spend a certain amount of time to qualify for citizenship. For instance, the top CBI programs in Europe are Malta, and Austria that not only offer a high-quality passport but also settlement rights to 27 countries in the European Union.

On the other hand, the RBI programs provide you the right to live, work, travel and study in a particular country. These programs usually come with certain conditions or requirements that you need to meet to qualify for the program. For instance, the Portugal Golden Residence Permit Program is one of the popular programs in the European Union whereby apart from meeting the investment criteria with a lock-in for a certain period, you need to meet the stay requirements too.

While remote lifestyles, healthcare facilities, pandemic responses and safe havens have become added factors to evaluate such programs, there are many other reasons that private clients consider when evaluating investment migration options.

The motivations can be lifestyle driven, perhaps better standard of living, education plans for children or grandchildren, proximity to family members or even future retirement plans. Individuals are also looking at programs at the family level i.e. programs that include parents and children under one application.

At the other end of the spectrum, political or economic issues in home country or the need to have a ‘Plan B’ to safeguard against such issues emerging later are other driving factors.

When you evaluate such programs, it is important to understand your objectives to ascertain the suitability of a residence or citizenship program. Various factors such as cost, time, goals at the individual and family level need to be further assessed before concluding on a suitable migration option.

Whether you choose your second home address in the European landscapes of Portugal or the picturesque countryside in the United Kingdom, it is important to choose the right advisor who can facilitate comprehensive advice from pre-migration to post-migration!

For more information connect with +91 98219 25479 sneha.makhija@sanctumwealth.com

There are multiples ways available to invest internationally. One of the simplest ways to take global exposure is by using India domiciled funds and exchange traded funds (ETFs) that invest in international markets. There are 39 such funds and ETFs now available in India. These funds could directly invest in global securities or could invest in a foreign domiciled fund that invests in global securities. Few benefits and key features are highlighted below.

Sharp Rise in Investor Interest Assets managed by these funds has more than doubled in the last 1 year. Sanctum Global Allocator For investors that want an actively managed global equity portfolio, Sanctum Wealth offers a PMS strategy that allows one to dynamically allocate across geographies. Key Features: Performance Highlights The strategy has outperformed its benchmark (75% MSCI World and 25% MSCI Emerging Market Index) and Nifty over the last 6-month, 1 year and since inception.Benefits