Investment Outlook – Trend 3 , Published Mar 16, 2017

Decade-long flows into the U.S., a secular bond bull run and massive liquidity surges are now reversing.

The River Flow Analogy

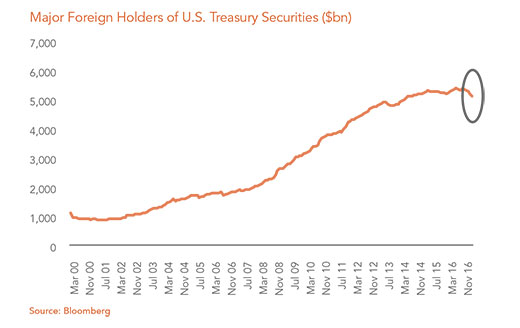

Several flows have been at play over the past two decades in suppressing U.S. bond yields.

Now the Chinese and Saudis are sellers of the U.S. treasuries, the Europeans have stopped QE and tapering. And the Fed has reverse course and is hiking rate.

We are Entering a New Era in Global Finance

Since LTCM in 1998, the defining force in global investing has been the Greenspan and Bernanke Fed. Monetary policy has been dominant in defining market direction and sustaining bull markets.

Looking at a generational reversal in liquidity, we cannot help but ask, “If the inputs were powerful enough to spur liquidity driven bull markets around the world, will the withdrawal of liquidity not act as an equally powerful force in the opposite direction”?

It is equally worthwhile to ask: “Are we entering a new era in global finance?” The answer to this question seems to be an unequivocal yes, whether it be a shift in philosophy, a shift in monetary policy or a shift in populist sentiments.

Is Fiscal Stimulus the Silver Bullet?

QE Reversal is being accompanied by fiscal stimulus. The markets seem to have conveniently set aside the debt problems that were facing the world for the past seven years. Mr. Trump is riding in with the cavalry.

It is worth considering, though, that for years, the Chinese poured vast amounts of capital into infrastructure. That is precisely what the U.S. intends to do. Years later, the Chinese are still bringing stimulus upon stimulus to spur the domestic economy with no improvement in the prospects of the average Chinese citizen.

Let us acknowledge that fiscal stimulus is not a silver bullet and often it is a temporary shot in the arm. Unless accompanied by needed reforms, the patient will experience temporary and reversible benefits.

Or will Rising Inflation, Rising Interest Rates & Flow Reversals Prevail?

Do not fight the Fed. That is precisely what investors have chosen to do. If the economy recovers, which is the consensus view; it is likely the Fed will be looking to raise rates. We would look for buyer’s remorse to hit institutional investors in the U.S. at some point in the coming months.

Donald Trump’s proposed protectionist trade policies will likely lead to inflation and higher-paying U.S. jobs, albeit fewer of them. The populist movement is rebelling against the deflationary tendencies of manufacturers chasing lower wages the world over. OPEC cutting production and a rising commodity cycle spell further bad news.

We are moving from a world where rivers flowed smoothly in one direction to a world where river flows are about to crash into each other, creating waves or what is generally known as volatility in developed markets.

Download ReportInvestment Outlook 2017