Investment Outlook , Published Feb 17, 2019

Sunil Sharma

CIO at Sanctum Wealth Management.In 2018, we were advising investors to cut back on equity allocations. In contrast, as we head into 2019, the macro picture looks favourable for equities.

Overview

Elections, fiscal stimulus, the Fed and U.S. China trade war are likely to garner short term focus, but lower crude, low inflation, accommodative central banks, structural reforms, a resurgent technology sector, rising consumption and rising domestic flows remain key underpinnings that will drive India’s economic growth.

We live in an age

of privilege, where

investors have

access to large

amounts of information.

The other p/b ratio – price to brent

Over the past two decades, bottoms in crude oil have coincided with subsequently strong

returns in Indian equities. With the news of a doubling of reserves in the Permian Basin, and

expectations of meaningful supply coming on in late 2019, Brent crude prices have come

down 26% from the peak. Longer term, the onset of EVs will further impede demand. Benign

crude prices bode well for India’s fiscal situation. The Price to Brent ratio suggests a favourable

environment for equities ahead.

Strong FII selling normally precedes good years

We experienced the largest FII selling in India since 2008 last year in equities. FIIs were big

sellers in 2008, 2011, 2013, and 2015. In each instance, FIIs returned to the India market.

What followed in each instance were good years in the markets.

Strong FII selling normally precedes good years

We experienced the largest FII selling in India since 2008 last year in equities. FIIs were big

sellers in 2008, 2011, 2013, and 2015. In each instance, FIIs returned to the India market.

What followed in each instance were good years in the markets.

Accommodative central bankers

A neutral Fed, a stabilising Fed Balance

Sheet and an accommodative RBI add to

our positive macro outlook. Accommodative

RBI policy starting in late 2001, late

2008, early 2012, and early 2014 was a precursor

to healthy equity markets. The track

record during declining interest rate environments

suggest a similarly favourable

outlook. (See table)

Dominance, vulnerability and cap

Throughout the global economy, big companies

keep getting bigger, more productive,

more profitable, more innovative. Over

time, we expect the largest four names in any

sector to control 90% plus market share. We

are not anywhere close to that situation in

India.

Large caps enjoy increasingly dominant

competitive positioning with the lower cost

of capital, distribution leverage, reputation, and

brand advantages. However, the dominance

can be ephemeral, particularly in

technology; witness Apple, Facebook, and

Tesla. On the other hand, distribution, pricing

power, and branding stand the test of

time; hence Britannia and Hindustan

Unilever sport premium valuations.

While the valuation multiples of mid caps

and small caps have moved to a discount

relative to large caps, the volatility of small

and mid caps has appeared to have caused

a lasting aversion amongst investors. Investors

are increasingly preferring the steadier

returns of larger caps. We note, however,

that forward 3 year expected returns look

attractive for small and mid caps.

The chatter around a yield curve inversion

and U.S. slowdown may also be driving a

preference towards large caps. We favour a

portfolio tilted to large caps, with selective

exposure to high-quality growth mid cap

and small cap in investment portfolios.

Accommodative central bankers

A neutral Fed, a stabilising Fed Balance

Sheet and an accommodative RBI add to

our positive macro outlook. Accommodative

RBI policy starting in late 2001, late

2008, early 2012, and early 2014 was a precursor

to healthy equity markets. The track

record during declining interest rate environments

suggest a similarly favourable

outlook. (See table)

Dominance, vulnerability and cap

Throughout the global economy, big companies

keep getting bigger, more productive,

more profitable, more innovative. Over

time, we expect the largest four names in any

sector to control 90% plus market share. We

are not anywhere close to that situation in

India.

Large caps enjoy increasingly dominant

competitive positioning with the lower cost

of capital, distribution leverage, reputation, and

brand advantages. However, the dominance

can be ephemeral, particularly in

technology; witness Apple, Facebook, and

Tesla. On the other hand, distribution, pricing

power, and branding stand the test of

time; hence Britannia and Hindustan

Unilever sport premium valuations.

While the valuation multiples of mid caps

and small caps have moved to a discount

relative to large caps, the volatility of small

and mid caps has appeared to have caused

a lasting aversion amongst investors. Investors

are increasingly preferring the steadier

returns of larger caps. We note, however,

that forward 3 year expected returns look

attractive for small and mid caps.

The chatter around a yield curve inversion

and U.S. slowdown may also be driving a

preference towards large caps. We favour a

portfolio tilted to large caps, with selective

exposure to high-quality growth mid cap

and small cap in investment portfolios.

Domestic over global growth

The shift of growth to Asia is unfolding along

expected lines. Germany, France and the U.K.

are making way for India and Indonesia in the

top 10 economies list. EM countries will

account for roughly 50% of global GDP by

2030. As emerging markets develop, the

nature of growth will remain domestic and

consumer driven. The growth of world population

by 750 million, nearly all of it originating

in emerging economies, will account for

about one-quarter of the rise in GDP.

Increased productivity will generate the rest.

This bodes well for Asia, India and domestic-

focused investments.

Equities

The macro picture looks fairly good heading

into 2019 for Indian equities, buffeted by domestic flows, declining rates, low inflation,

lower crude, and accommodative bank

policy.

There remains an excess of capital chasing

fewer attractive opportunities. The U.S. has

$37 trillion in assets under management.

India’s is a fraction of that, and India’s

market cap is less than 2% of the global

market cap. Domestically, substantial capital

sits on the side-lines. Global economic

growth slowing remains a risk to our outlook,

as do elections and credit stress.

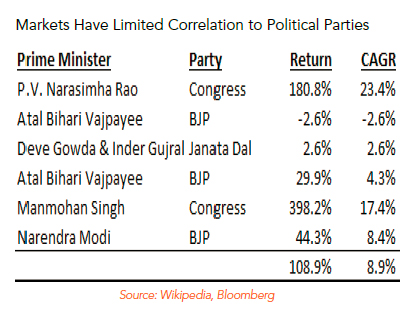

Interestingly, the data on equity performance

during various political regimes

clearly demonstrates that the equity markets

have little if any direct correlation to the

political party in power.

At some point, a divergence between our

markets and developed markets is inevitable.

Domestic over global growth

The shift of growth to Asia is unfolding along

expected lines. Germany, France and the U.K.

are making way for India and Indonesia in the

top 10 economies list. EM countries will

account for roughly 50% of global GDP by

2030. As emerging markets develop, the

nature of growth will remain domestic and

consumer driven. The growth of world population

by 750 million, nearly all of it originating

in emerging economies, will account for

about one-quarter of the rise in GDP.

Increased productivity will generate the rest.

This bodes well for Asia, India and domestic-

focused investments.

Equities

The macro picture looks fairly good heading

into 2019 for Indian equities, buffeted by domestic flows, declining rates, low inflation,

lower crude, and accommodative bank

policy.

There remains an excess of capital chasing

fewer attractive opportunities. The U.S. has

$37 trillion in assets under management.

India’s is a fraction of that, and India’s

market cap is less than 2% of the global

market cap. Domestically, substantial capital

sits on the side-lines. Global economic

growth slowing remains a risk to our outlook,

as do elections and credit stress.

Interestingly, the data on equity performance

during various political regimes

clearly demonstrates that the equity markets

have little if any direct correlation to the

political party in power.

At some point, a divergence between our

markets and developed markets is inevitable.

Source: IMF Data Mapper

Last year, we were advising investors to trim equity allocations and be weary of over-exuberance. Today, recognising year-end forecasts are fraught with risk, we are of the view that the macro environment for equities is favourable. In the final analysis, anything meaningful that one wants to accomplish in life and investing takes time and rarely is it easy. Extending time horizons and accepting volatility as the price of admission tilts the odds in one’s favour. Amazon built great wealth for investors, but along the way, there were 5 painful 25-30% corrections. There is likely to be volatility in the beginning of the year as uncertainties remain front and center. Our advice remains simple: align with trusted, competent, service providers, outsource or automate as much as possible, because time is the only commodity that cannot be purchased. Despite their billions, none of us would trade places with Warren Buffett or Rupert Murdoch.There is likely to be volatility in the beginning of the year as uncertainties remain front and center.

Fixed Income

Global macro conditions remain fairly

favourable, with low crude, low inflation

and accommodative central bank policy

favouring a downward bias on interest

rates. Our forward expectation on crude

pricing is close to current levels, but with a

fairly wide range of deviation. Elections

have brought forth populist announcements

as expected. These represent a risk to the

debt outlook and could exert upward

pressure on rates.

Following in the wisdom of Winston

Churchill, the IL&FS crisis is certainly a good

crisis and does not appear to have gone to

waste. Its after-effects are resonating into

the New Year. Governance, promoter

integrity and those familiar enemies of

business continuity – greed and leverage –

have come to the fore. In the big picture, a

healthy cleansing is underway and the

system should emerge stronger.

In the shorter term, however, these players

are facing challenges in rolling over

maturities and this could potentially impact

debt mutual fund returns. Traditionally,

credit managers have a reputation for deep

analysis and strong due diligence. It is

however, becoming abundantly evident

that many debt fund managers have not

lived up to their fiduciary responsibilities as

responsible allocators of capital that are

supposed to prioritize the most

fundamental notion of safety of principal.

The market will exact a price from those

found lacking, and separate the men from

the boys.

An annual forecast on interest rates is

fraught with a fair bit of risk and uncertainty,

and this year is no exception. With benign

longer term expectations on crude, global

inflation and high domestic real rates, an

argument can be made for a downward

drift on interest rates longer term.

However, uncertainties domestically need

to play out, and worsening credit

conditions remain a risk in the near term

that must be acknowledged. In such a

scenario, we favour the short end of the

curve, higher rated, clean credit, short

duration until risk is clearly priced in and

clarified. We also prefer exposure via

principal protected structured strategies

with upside participation.

Fixed Income

Global macro conditions remain fairly

favourable, with low crude, low inflation

and accommodative central bank policy

favouring a downward bias on interest

rates. Our forward expectation on crude

pricing is close to current levels, but with a

fairly wide range of deviation. Elections

have brought forth populist announcements

as expected. These represent a risk to the

debt outlook and could exert upward

pressure on rates.

Following in the wisdom of Winston

Churchill, the IL&FS crisis is certainly a good

crisis and does not appear to have gone to

waste. Its after-effects are resonating into

the New Year. Governance, promoter

integrity and those familiar enemies of

business continuity – greed and leverage –

have come to the fore. In the big picture, a

healthy cleansing is underway and the

system should emerge stronger.

In the shorter term, however, these players

are facing challenges in rolling over

maturities and this could potentially impact

debt mutual fund returns. Traditionally,

credit managers have a reputation for deep

analysis and strong due diligence. It is

however, becoming abundantly evident

that many debt fund managers have not

lived up to their fiduciary responsibilities as

responsible allocators of capital that are

supposed to prioritize the most

fundamental notion of safety of principal.

The market will exact a price from those

found lacking, and separate the men from

the boys.

An annual forecast on interest rates is

fraught with a fair bit of risk and uncertainty,

and this year is no exception. With benign

longer term expectations on crude, global

inflation and high domestic real rates, an

argument can be made for a downward

drift on interest rates longer term.

However, uncertainties domestically need

to play out, and worsening credit

conditions remain a risk in the near term

that must be acknowledged. In such a

scenario, we favour the short end of the

curve, higher rated, clean credit, short

duration until risk is clearly priced in and

clarified. We also prefer exposure via

principal protected structured strategies

with upside participation.

An annual forecast on

interest rates is

fraught with a fair bit

of risk and

uncertainty, and this

year is no exception.

Gold

Gold has broken out of its trading range

recently, and deserves an allocation in

investor portfolios. Should the macro fundamental

picture change, we would consider

a review of our allocations.

Sectoral Outlook

Consumption remains our key focus area,

poised to benefit from government

largesse. We continue to like financials in

the current stage of the business cycle, particularly

private and corporate banks. The

Technology sector appears to have successfully

transitioned to digital transformation

from the days of BPO, and technology

remains fairly priced. We remain interested

in automation and productivity improvement.

With 2008 fresh in the minds of most investors,

risk-reducing behavioural changes may

have made the system more stable and a

severe crisis less likely. When everyone is

too afraid to take big risks, it is hard to get a

truly threatening bubble underway. As we

move to $2000 per capita annual income,

consumption is likely to grow. Of the next

billion customers, a good-sized chunk will

originate out of India.

Download Investment Outlook 2019

Download Investment Outlook 2018

Download Investment Outlook 2017

Download Investment Outlook 2019

Download Investment Outlook 2018

Download Investment Outlook 2017

Investment Outlook 2019