Investment Outlook – Trend 5 , Published Mar 16, 2017

A momentous shift in the crude Global Order occurred in 2016. With Saudi Arabia losing its stronghold on crude Oil pricing, our long-term view on crude remains range bound, as shale oil looks set to come on.

A Third Momentous Shift in the Global Order

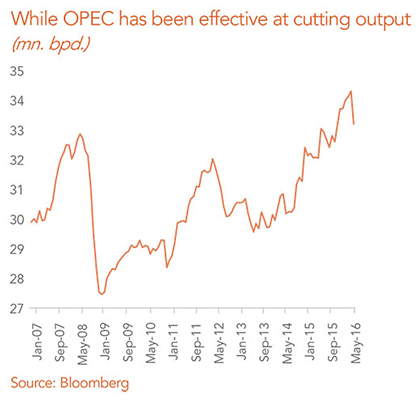

The strategy of over production to drop prices and drive out competition was used effectively by John D. Rockefeller many decades ago. Saudis thought they would pull a page out of the same playbook. Needless to say, U.S. shale proved to be resilient and the results have been catastrophic for the House of Saud, with deficits ratcheting higher, lost profits and depletion of capital reserves. The new OPEC deal to cut oil output amounts to nothing less than a strategic failure by Saudi Arabia and its surrender to the emerging power of American shale. The key beneficiaries for the OPEC deal look to be the U.S., Russia (gaining market share) and Iran (maintaining production levels).

While Russia has agreed to a cut of 300,000bpd it is unclear whether they will actually live up to their commitment. To compare, Saudi Arabia pumped 10.6 million bpd in November, and now has to cut 486,000 bpd from that figure. Neighbouring Iraq, Kuwait, Qatar, and the UAE, will cut a combined 510,000 bpd from their output. This is not withstanding high deficits of 9-20% of GDP for them.

The loss of power for OPEC amounts to a third momentous shift in global power along the lines of the Brexit vote, and the Trump victory, bringing to a close, decades of OPEC domination of the world’s crude market.

OPEC now accounts for less than half of all the energy output in the world, hardly a cartel, dependent on the largesse of external players to survive.

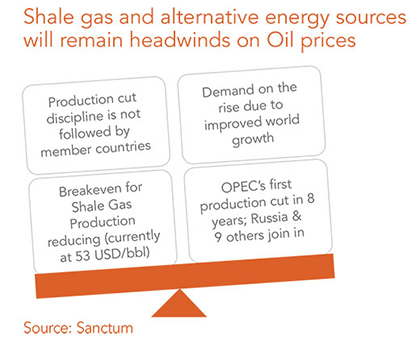

Further, the survival of shale oil has effectively set a permanent headwind for the global price of oil. Even if prices sustainably drift upwards, this would make the relatively more agile U.S. shale producers resume production, exerting downward pressure on prices. If oil prices were to rise well into the $50s per barrel, production could be profitable in virtually all of the major shale basins.

For long-term investors, OPEC is fighting forces that are stronger and beyond their control. The cost of producing crude, largely due to fracking technology, has dramatically changed the marginal economics of oil. Improving economics for alternative energies represent additional headwinds.

Outlook for Crude Oil

A strong rebound in shale drilling could doom the very price rally that sparked the revival. Oil at $55would bring back some 800,000 bpd in shale online.

Led by India, it is likely that global supply demand will flip to deficit from surplus; however, this is only likely to be the case until U.S. shale supply start hitting the markets. India’s $2 trillion economy imports more than 80% of its crude requirement and the International Energy Agency expects it to be the fastest-growing consumer through 2040.

Similar to Crude, Natural Gas is Emerging as a Global Commodity

Natural gas is taking on the characteristics of a global-macro market, like crude, where global factors influence what happens to prices. While the shale oil producers have already taken the fight to the OPEC nations for crude oil production, natural gas producers are also out to assert their supremacy. Gas is a further sign of the growing strength of U.S.’ production power and changing dynamics in the world energy market.

U.S. natural gas exports exceeded imports in early November last year. Shale oil producers have turned the U.S. from a net importer into a net exporter of natural gas in November. The U.S. surpassed Russia as the largest producer of natural gas in 2011, according to the EIA at 80 billion cubic feet of production per day, producing 25% of the world’s total. In terms of target markets, demand is seen to be increasing from China, India and ASEAN countries. Europe is in play, too, with the U.S. trying to compete with Russia, which supplies 40% of the European Union’s gas imports.

Investment Outlook 2017