Trend 9: The Finance Minister’s Gambit: Balancing Fiscal Expansion with Prudence

Investment Outlook – Trend 9 ,

Published

Mar 16, 2017

The overall FY18 budget was fairly expansionary with expenditure up 6.6% even on a high revised base in FY17.

The expansionary budget notwithstanding, the Finance Minister (F.M.) pegged the fiscal deficit for FY18 at 3.2% of the GDP and remains committed to achieve 3% in FY19.

Workman-like Budget Delivery

The balanced fiscal prudence should

likely help in keeping inflation range-bound which should help in curbing interest rates further. Coupled with the sustainable debt path and reduced revenue deficit this should potentially help in

improved credit ratings. As a result, foreign inflows – an undoubted boon for the markets –should improve. Increases in budgeted amount from disinvestments and potential listings of certain PSUs should act as further tailwinds.

No bad news is good news

Taxation Cuts “Measured” Fillip to Sentiment

The F.M. presented an effective corporate tax rate of 25% for small companies, highlighting the

pro-MSME stance. This should help alleviate the pain of small, cash-focused businesses currently suffering from extended working capital cycles due to demonetisation.

Simultaneously, with the

tax base set to increase from digitalisation and compliance stemming from demonetisation, the Government has also slashed tax rates from 10% to 5% for individuals with income between INR 2.5 lakhs to INR 5 lakhs. This has however, partly been offset by surcharge of 10% for income between INR 50 lakhs to INR 1 crore. Net net, we believe this should

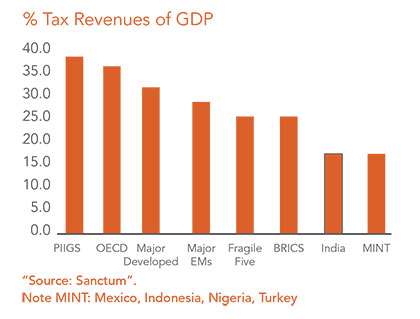

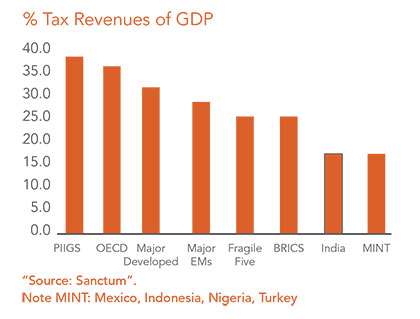

elevate India’s currently anaemic tax/GDP ratio which is below the average of emerging markets and OECD markets of about 27% and 34% respectively.

However, there remain a couple of niggles which markets seem to have conveniently ignored.

- In a bid to increase India’s global corporate competence, India had agreed to slash the corporate tax rate from 30% to 25%.Unfortunately, the current cut to 25% does not really help this cause as the companies expected to gain from this windfall being MSMEs, do not compete on a global scale.

- The cut in the income tax rates at the base of the tax pyramid while hailed as a saviour for the demonetised masses could in fact be construed as skimping out on giving cash benefit back to the masses. Instead of possibly depositing the garnered black money back into Jan-Dhan accounts, this windfall would be going into general Government spending i.e. a benefit has been deferred to the future rather than taken up-front.

Consequently, we believe these measures have achieved only a “measured” positive impetus on the Consumer side of the economy. Markets currently, have already priced in the Government’s fiscal prudence and corporate investment pledges in the form of a relief rally post the budget.

Sustained Focus on Infrastructure and Rural Investments

The spending on Infra related ministries particularly in shipping and urban development (metro rails) has seen

increased revised allocations in FY17 (from initial budgeted estimates) and

even more allocation amounts in FY18. So spending here has not yet peaked. Allocation for roads has been stepped up 12% compared to last year. For the transportation sector as a whole, including shipping and rail, there is a total of INR 2,41,387 cr. targeted. Such a large number will spur economic activity across the country.

Rural development has also been a consistent target for expansion with the Government adhering to its goal of

doubling farmer income by 2022.

Rise of a Cleaner Economy

Overall, the markets cheered the workman-like budget with the hope of the economy gradually becoming cleaner. The legitimate campaign waged against black money has given rise to many positive offshoots such as transitioning to a more

transparent and compliant economy due to the rise in

digital transactions (as discussed in our demonetisation section). The move to a cashless society, efforts of bringing in transparency in the electoral funding among other announcements point to a significant

cleansing of black money in the economy, which in the long run should undoubtedly boost the GDP.

Download Report

Also read about:

Investment Outlook 2017

However, there remain a couple of niggles which markets seem to have conveniently ignored.

However, there remain a couple of niggles which markets seem to have conveniently ignored.