Investment Outlook , Published Feb 17, 2019

Gary Dugan

CEO Purple Asset Management Pte. Ltd.

and Advisor to Sanctum Global Allocator*.

The hope of a re-acceleration in growth depends on external factors like oil prices cooling off, thereby, helping the global economy.

Overview

2019 will be a challenging year for the global economy. Many of the previous drivers of global growth are on the wane. Reversal of QE measures to slow down global liquidity, while government spending will remain under check.

Industrialists and investors will find the world outside of India less supportive over the coming twelve months. Judging by the way 2018 ended, 2019 will prove to be a challenging year for the global economy. Many of the previous drivers of global growth appear to be on the wane.

Over the past decade, the global economy and financial markets have benefitted from near-zero interest rates, quantitative easing (free money), and sharp increases in government spending. Initially, these actions saved the world from depression and eventually boosted global growth.

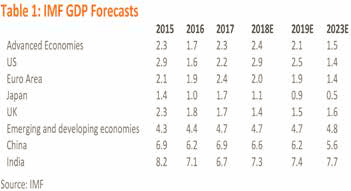

To quote the IMF “Global growth for 2018–19 is projected to remain steady at its 2017 level, but its pace is less vigorous than what was projected in April (2018) and it has become less balanced. Downside risks to global growth have risen in the past six months and the potential for upside surprises has receded.” (World Economic Outlook 2018).

The recent sharp fall in oil prices, for example, will help to bring down inflation and make consumers feel that they have more spending power. However, there are probably just too many factors working against growth in the coming year.

The positive factors going into reverse

Interest rates – were very low and are now rising

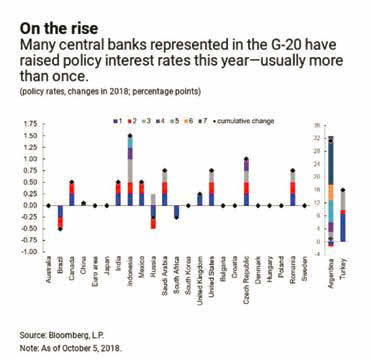

Around the world, we are seeing central banks raise interest rates and/or market interest rates. The key driver has been the US Fed funds rate that has risen 200bps from its low. In effect whatever the Fed did, many other central banks have had to mirror. The good news is that maybe the Fed is not going to press on with further interest rate increases in 2019. But it is also bad news because it would reflect weaker US growth.

*Sanctum Global Allocator is a strategy which invests in a basket of best in class global mutual funds & provides geographical diversification to domestic investor’s portfolios

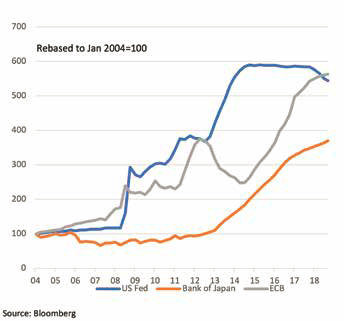

Central banks full on Quantitative Easing goes into reverse

The flow of liquidity is however, starting to dry up. In addition to near-zero interest rates, the global economy has had the benefit of substantial flows of liquidity flowing into asset prices. But, the Federal Reserve has already started to withdraw money from the programme. Also, the ECB is in the early stages of reversing their QE. The Bank of Japan continues to increase its QE although at a slightly lower rate.

Central Bank Quantitative Easing no longer at full throttle

The Bank of Japan continues to increase its QE although at a slightly lower rate.

Governments were spending, but now they are tightening their purse strings

A further source of stimulus to the global economy has been government spending. Significant fiscal deficits have not just been a feature of the world financial crisis. In the past twelve months, President Trump pushed on with a significant package of tax cuts and increased spending. The package served to boost US growth and ignite a positive mood in much of the global economy. However, in recent months the market is seeing the package for what it’s worth – a one-off, that even the US government cannot afford to repeat. Indeed, in much of the developed world, there is little appetite for significant increases in government spending.

Governments are tightening their purse strings

Trade wars that have become a new source of angst for the global economy and markets are unlikely to go away. The US administration is fighting a rear-guard action to defend against the inevitable competition that comes from the ongoing rapid growth of BRIC countries.

Download Investment Outlook 2019Investment Outlook 2019