Investment Outlook – Trend 6 , Published Mar 16, 2017

Rising risks from the upcoming French elections and strong rhetoric launched by the Trump administration against Germany have sparked uncertainty.

Rising Geo-Political Risks

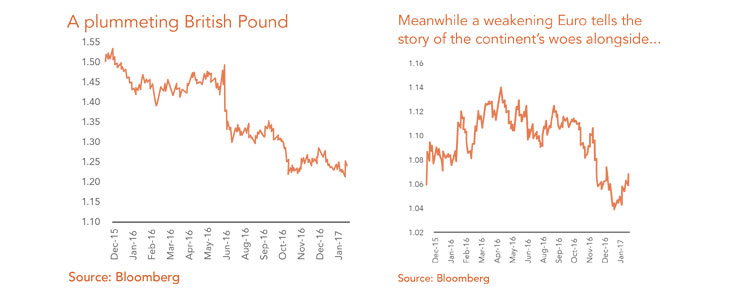

We enter 2017 with increased policy uncertainty in Europe (Brexit, Italian referendum, immigrants, French and German elections), U.S. and Russia.

No Good Options for Italy and the Eurozone

Italians that are warned about the implications of a ‘No’ vote shrug their shoulders, saying it has been 20 years of no growth, so how would a few more make a difference? Italy is a culture that has persevered through political instability, banking crises, economic stagnation. With capital flowing north, out of Italy, it is only a matter of time before this emerges into a crisis requiring a bailout. Fairly soon the Italian government and/or the European Central Bank (ECB) will have to step in to bail out the banks. Italy would then be faced with onerous requirements imposed by the European Stability Mechanism, similar to those from which Greece is still suffering. The Italians would strongly resist this outcome, and a serious Eurozone political crisis could arise.

France’s Presidential Race Remains at the Top of the List of Key Events in 2017

The revolution that gave us Brexit and Trump could be about to hit France. The National Front’s Marine Le Pen has the French elites quaking in their boots. Her opponent appears to be former P.M. François Fill on. Le Pen is running on a nationalistic, anti-Islamist, anti-globalisation, anti-third world immigration platform. She is expected to win the first round of voting in April. A hardliner on immigration and Islamism, she is sceptical of free trade deals, in favour of increasing taxes on the rich and opposed to harsh austerity measures. Like Trump, therefore, it is hard to lock her into a typical left/right category. A President Le Pen would almost certainly join the U.K. in pulling the plug on its E.U. membership. France is one of the two core members (along with Germany) and its departure would be a critical blow to the Union. Should LePen win, the European Union will be thrown into a crisis.

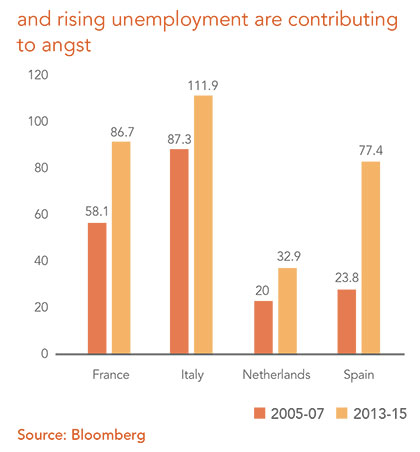

The Deplorables Question Globalisation

Globalisation is good for the haves and bad for the have-nots. The Brexit vote showed that half of British voters did not think being part of the European Union was good. Globalisation has many discontents. They are the losers from globalisation, and the view is gaining currency that a mechanism to compensate losers must be considered. Those who voted for Brexit or Trump did not simply fail to understand the true benefits of globalisation; they currently lack the skills or opportunities to secure a piece of the pie. Beyond communication, therefore, lies a genuine need for redistributive policies. The main beneficiaries of free trade and technological change must actively compensate the loser through subsidies, and employment support. Globalisation also created endless immigration, and countries are turning protectionist.

An Inflection Point in Populism

The seeds are being sown for an inflection point in the global economy with Trump and Brexit. Broad segments of the population are rejecting the status quo. The Great Recession that followed Lehman’s collapse enveloped the United States, Europe and Japan. Eight years on, extraordinary medicine has not worked. Maybe it is time to accept that real improvement happens via real reforms and rollbacks of excesses.

There are no quick fixes to the Eurozone’s problems. Sustained growth can bring sustained hangovers. In previous recessions, companies failed. This time, it is countries that are failing.

Download ReportInvestment Outlook 2017