Investment Outlook – Trend 7 , Published Mar 16, 2017

While there has been immense short term pain, the Economic Survey FY17estimates long term gain in the form of 6.75-7.5% FY18 real GDP growth. This should stem from an increase in the tax base as curbs on the estimated INR 3 lakh cr. black money (Economic Survey) are being made.

Rise of the Digital Economy – Bodes Well for Capital Markets

Short term pain for long term gain has been the narrative here. The motive was to curb the rising black money. The Economic Survey FY17 estimates black money worth INR 3 lakh cr. (2% of GDP) by comparing note “soil rates” in India and the U.S, Attacks on black money should lead to a rise in the tax base as individuals adhere to compliance. The long term gains can be witnessed with the Economic Survey pegging FY18 real GDP growth at 6.75-7.5%.

Cash as a percentage of consumer transactions in India ranged from 68% to 98%pre-demonetisation. Digitalisation has surged post demonetisation, as measured by the Economic Survey across all consumers. Aadhaar-Enabled Payments System (AEPS), RuPay transactions and card and pre-paid instruments have all shown surges post 8-Nov-16. Consequently, banks have targeted to introduce additional 10 lakh new PoS terminals by Mar-17. Digitalisation has also led to a flood of financial savings into the system. This domestic capital inflow is a major positive and reduces our vulnerability to the whims of FI investors.

Secondly, as cash usage decreases, the need for banks to provide cash management services, such as counting, processing, transporting, protecting, insuring are coming down and we expect this efficiency to translate to a rise in productivity for corporates and the economy.

Government Initiatives to Improve Transparency

The government has aggressively focused on transparency and financial inclusion, whether it be creation of Jan-Dhan accounts, implementation of Aadhaar based payments, the creation of a Special Investigation Team on black money (domestic and abroad), creation of a foreign black money disclosure window, the passage of the Black Money Act of 2015 for undeclared foreign assets, the Income Declaration Scheme (1) – 2016to declare undisclosed assets and requirement of PAN for purchases of jewellery and vehicles.

Transmission of Rates

Finally, rates on the 10 year are down almost 300 bps over the past 3 years and 120 bps in the past year; however, it is only post the flood of capital into the banking system as a result of demonetisation that banks have decided to aggressively pass on rate cuts.

The organised sector stands to benefit at the expense of the unorganised sector. This remains a net positive for large caps and to a lesser extent midcaps.

Negative Wealth Effect in Real Estate

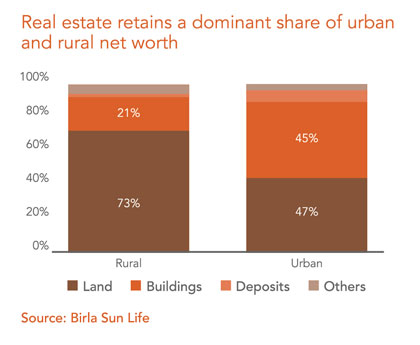

Real estate forms a major part of the net worth of most consumers. As a result, there is likely to be a negative wealth effect since the value of real estate has come down as most transactions are now being quoted in white. However, the decline in rates serves to offset this negative.

Impact to Nifty 50 Earnings

Most vulnerable are companies with high fixed costs and high proportion of transactions settled in cash. Regardless, the cash shortage situation has improved tremendously and as of this writing, availability of cash is not an issue in the larger metro areas. The hit to earnings will be temporary and we expect even the organised players severely impacted by the cash crunch will recover by the end of the current quarter.

A Rise in the Tax Base is Necessary

Net net, demonetisation improves the efficiency and transparency of the economy. An increase in CASA for banks alleviating the NPAs and a global recognition that India is making progress becoming a transparent and less cash economy, will make the long term benefits of demonetisation evident in the coming quarters.

Download ReportInvestment Outlook 2017