Sep 3, 2025

The world economy entered late summer with a mixed picture. In the United States, consumer spending

remained resilient, supported by a firm labour market and decent wage growth, but inflation in

services proved stubborn. That being said global economic data was baised to strnger than expected

and inflation lower than expected helping asset markets perform.

Markets grew increasingly confident that the Federal Reserve would cut rates in September as data

showed softer job creation and moderation in housing demand. Europe offered little surprise:

inflation sat close to 2%, giving the European Central Bank scope to contemplate easing later in the

year. China’s activity data showed manufacturing still stuck below expansionary territory, though

services improved, suggesting stabilisation. Japan’s inflation moderated but stayed above target,

while India continued to deliver rapid growth, powered by services and public investment.

Chart 1: Global Economic Surprise Indices – Inflation and Growth

Index

Source: Bloomberg

United States

The US economy in July 2025 showed a blend of resilience and strain. Consumer spending remained

solid, rising at a healthy monthly pace as households continued to draw on wage gains and

accumulated savings, though higher borrowing costs were clearly tempering demand for housing and

durable goods. Inflation stayed sticky in services, with the core PCE index running close to 3%

year-on-year, leaving the Federal Reserve in a delicate position. However, employment growth slowed

further, pointing to a gradual cooling of the labour market, yet unemployment remained low enough to

keep wage pressures alive. Against this backdrop, financial markets grew increasingly convinced that

the Fed would pivot towards its first rate cut in September, interpreting the summer’s data as

sufficient evidence that disinflation is progressing, albeit unevenly.

Europe

Economic momentum across Europe remained subdued in July.

Growth indicators suggested little more

than stagnation, with industrial output soft and consumer confidence fragile. Inflation, however,

continued to trend lower, with headline rates hovering near 2% and core easing gradually. This gave

the European Central Bank space to signal that policy easing later in the year was possible, though

officials remained cautious not to reignite price pressures. Political noise around fiscal rules and

budgetary debates, particularly in France and parts of southern Europe, added to market unease but

did not derail the broader narrative of disinflation and low growth.

Japan

Japan remained one of the brighter spots in the developed

world.

July brought further evidence of

stable, above-target inflation, largely supported by services and wage gains, while commodity-linked

pressures eased. Equity markets responded strongly, breaking record highs as foreign investors

poured money into Japanese assets, attracted by corporate reforms, share buybacks, and relative

currency weakness. The Bank of Japan held its cautious stance, but with inflation holding,

speculation grew that the central bank may take further steps towards policy normalisation. The

sense that Japan had broken out of decades of stagnation was increasingly reflected in both investor

sentiment and capital flows.

Asia ex-Japan

Across the rest of Asia, July was more mixed. China remained a drag, with manufacturing surveys

stuck below the threshold of expansion, though the services sector showed tentative stabilisation.

Investors looked for more targeted stimulus from Beijing to sustain growth momentum. India, by

contrast, powered ahead with another strong GDP reading, buoyed by services, infrastructure

spending, and healthy domestic demand. Southeast Asia navigated a middle path: external headwinds

from weak global trade were offset by resilient internal consumption, particularly in Indonesia and

the Philippines. Regional markets benefited from a softer US dollar, but sentiment remained split

between optimism on India’s structural story and concern over China’s sluggish recovery.

Chart 2: Emerging Market Surprise Indices Slip to Neutral

Index

Source: Bloomberg

Asset Markets

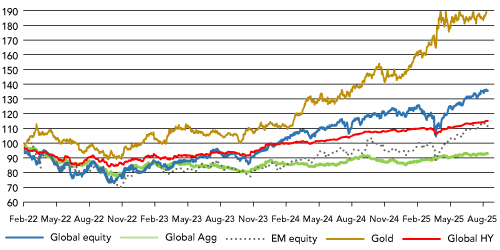

Chart 3: Asset Market Returns (since Jan 22)

Source: Bloomberg

Equities

Equity markets produced a generally positive performance in July, though regional outcomes varied.

In the United States, large-cap benchmarks advanced

steadily as investors digested dovish signals

from the Federal Reserve and grew more confident that policy easing was close at hand. Technology

remained a key driver, yet the rally broadened into smaller and cyclical companies towards the end

of the month, hinting at healthier market breadth. European equities

in local currency terms were

less inspiring, reflecting sluggish growth and political noise, with modest gains masking

persistent

investor caution. However the dollar’s weaknes enhanced returns for $ based investors. Japan, by

contrast, stood out as one of the strongest performers, with indices scaling new records

as

corporate reforms and steady earnings upgrades attracted a renewed wave of foreign capital. Again

dollar returns were enhanced by the strength of the Yen.

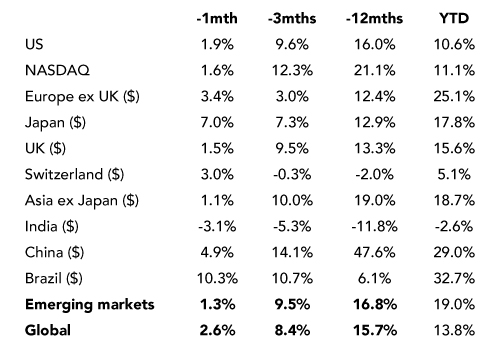

Table 1: Equity Market returns in August

Source: Bloomberg

Emerging markets had a more nuanced month

Latin America benefitted from softer inflation and currency strength, while Asia ex-Japan was held

back by China’s hesitant recovery, leaving performance uneven across the bloc.India performed

poorly, continuing its trend of underperformance, exacerbated by a lacklustre quarterly earnings

season. The impact of 50% US tariffs began to sink in as the month ended. Brazil also saw a setback

following an earlier run-up.

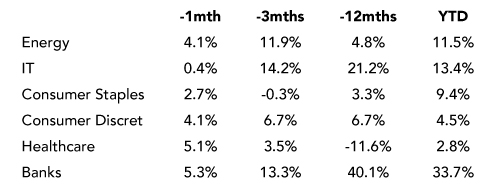

Equity sector performance

The Information Technology (IT) sector was quiet for a change. Nvidia results were broadly in line

with expectations and hence failed to provide an end of the month boost to the performance of the

sector. Banks sectors continued to outperform. The healthcare sector started to recover particularly

inspired by news that Warren Buffet’s fund had started to build positions in the sector.

Table 2: Global equity sector returns in August

Source: Bloomberg

Bond markets

August was a steadier month for bonds, marked by a broad decline in yields as markets looked ahead

to a potential September cut from the Federal Reserve. US Treasuries led the move, with the ten-year

yield settling in the low 4% range after spending much of early summer closer to mid-4s. The rally

was strongest at the front end of the curve, where investors adjusted positioning for imminent

easing. In Europe, Bund yields eased toward 2.7% as inflation data remained benign and the ECB

appeared more comfortable with its disinflation progress. UK gilts also found support, though the

conversation around government spending kept some pressure on the long end of the curve.

Chart 4: US 10 year Bond Yield in a Trading Range (%)

Source: Bloomberg

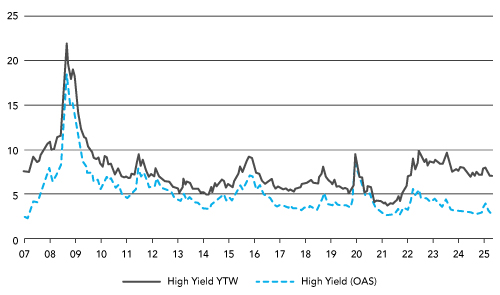

Chart 5: US High Yield spread slips back lower again (%)

Source: Bloomberg

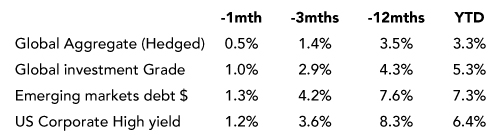

Table 3: Bond market returns In August

Source: Bloomberg

Credit markets reflected a strong appetite for risk.

Investment-grade spreads stayed pinned near

cycle lows, while high-yield spreads narrowed further, buoyed by improving market breadth in

equities and a calmer funding environment. Emerging market debt added to the constructive tone,

drawing inflows as the softer dollar and declining global yields improved the appeal of both

hard-currency and local-currency bonds, though country-specific inflation risks kept performance

uneven.

In the credit sector, high-yield bonds demonstrated resilience, but

more modest returns as already tight spreads constrained capital returns.

FX and Precious metals

The dollar softened in August, losing around 2% on its trade-weighted

index as investors prepared for a September rate cut from the Federal Reserve. The euro gained

modestly, supported by stable inflation and a sense that the ECB would move more slowly

than the

Fed in adjusting policy. Sterling was firmer, but only by about 0.4%

over the month — enough to

mark progress, but far from a breakout, with fiscal concerns and uneven domestic data keeping

investors cautious. The yen was volatile but ended the month

stronger, as falling US yields

unwound some of the carry-trade pressure.

Emerging market currencies broadly benefitted from the weaker dollar

backdrop: India’s rupee found steady support from a strong GDP report, whereas China’s

yuan

weakened as capital outflows persisted, underscoring the divergence within Asia.

Table 4: Monthly performance of precious metals and currencies for

August

Source: Bloomberg

Gold told the opposite story, strengthening to record highs

above

$3,400 per ounce. A weaker dollar, political noise around US monetary governance, and expectations

of a Fed rate cut created a perfect mix for renewed demand, underlining gold’s safe-haven appeal

in uncertain times.

In August 2025, Bitcoin surged to new record highs above $124,000 before sharp profit-taking

triggered a heavy correction. A mid-month wave of liquidations erased over a billion dollars of

positions, dragging prices back toward $108,000. By month-end, it stabilised around $110,000,

leaving the market balanced between strong institutional demand and persistent volatility.