May 2, 2025

The world may have fundamentally shifted following President Trump’s declaration on Freedom Day in early April, marking a pivotal moment in the global economic landscape. With the U.S. taking a more insular approach, globalization appears to be heading into reverse. The reverberations of this policy shift are already being felt across international trade, investment flows, and diplomatic relations. Countries that once relied on the open exchange of goods, services, and capital are now facing a more fragmented and uncertain environment.

The U.S.’s focus on domestic economic interests and its retreat from multilateral agreements is prompting a reordering of global supply chains, forcing businesses and governments to reconsider their strategies for economic growth and international cooperation. This shift signals not just a change in U.S. policy, but a broader transformation in the way the world approaches interconnectedness, potentially undoing decades of progress in global integration

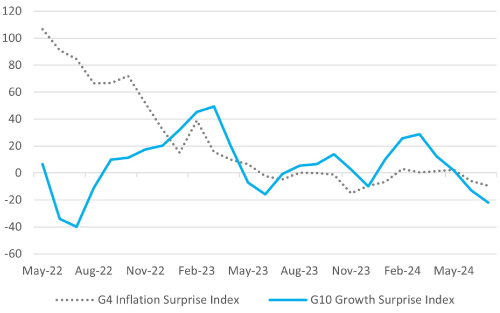

Chart 1: Global economic surprises show growth weakness, and lower inflation until….

Index

Source: Bloomberg

As investors fret about the future, recent economic data has been generally unremarkable, though it’s somewhat distorted by the looming fear of punitive tariffs. China’s economy had built a good head of steam before the tariff issue hit, and there’s still a sense that domestic demand is holding up well. U.S. Q1 GDP growth, however, was weaker than expected, showing a negative quarter-on-quarter performance, largely due to the drag from strong import volumes as companies scrambled to stock up ahead of the tariff hikes.

It could have been much worse in April if not for the U.S. government’s decision to pause the introduction of tariffs in several cases for 90 days. Bilateral negotiations are ongoing, but by the end of the quarter, there’s a growing sense that, after what could have been a sweet spot for the global economy—combining solid growth with low inflation and rates—we’re now facing a less favourable outlook. Growth is slowing, bordering on recession in some places, while inflation is rising, and in some instances, higher interest rates seem increasingly likely.

The Eurozone economy showed resilience in early 2025, with a 0.4% quarter-on-quarter growth in Q1, surpassing U.S. performance during the same period. This uptick was partly driven by American firms stockpiling European goods ahead of anticipated tariffs. However, the imposition of a 25% U.S. tariff on cars, steel, and aluminium has raised concerns about future export demand and investment. Some forecasters expect eurozone growth to be half of the level previously envisaged. The European Central Bank (ECB) responded by cutting interest rates to 2.25% in April, aiming to mitigate potential recession risks. Despite these challenges, the ECB projects a modest recovery, with GDP growth expected to rise from 0.9% in 2025 to 1.3% by 2027. Inflation is anticipated to moderate, declining from 2.2% in 2025 to 1.9% by 2027.

Japan: Navigating Economic Uncertainty

Japan’s economy faces headwinds as the Bank of Japan (BOJ) revises its growth forecast downward to 0.5% from 1.0% for 2025, citing uncertainties stemming from U.S. tariff policies. Inflation is projected to fall below the BOJ’s target, reaching 1.7% but only by 2026. The BOJ maintains a cautious stance, keeping interest rates unchanged at 0.5% and signaling potential future rate hikes if economic conditions improve. Despite these challenges, Japan’s economy shows signs of resilience, with moderate consumption growth and a tight labour market supporting gradual wage and price increases.

Markets

Equities

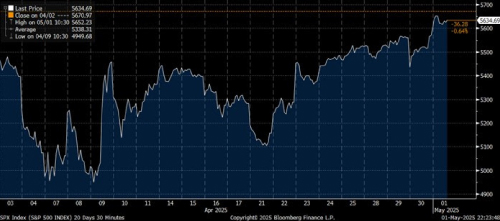

Like many assets the early days of April were troublesome. President Trumps tariffs put equities under immense pressure early in the month with US equities in particular very volatile.

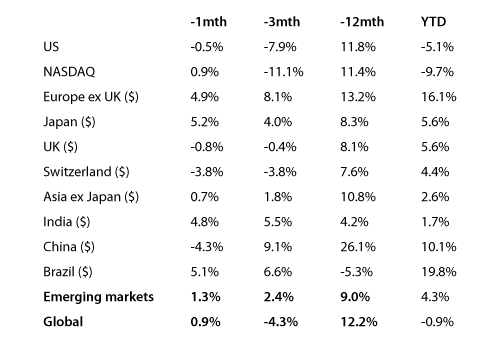

The pause in some tariffs helped to stabilise the equity market performances. Both Europe and Japan fared well through the month in dollar terms. Returns were largely explained by the weakness of the dollar. European markets showed resilience in April, largely driven by favourable economic data and a weaker U.S. dollar. Many multinational firms in the Eurozone saw their revenues increase when converted back into euros. The region’s relatively stable economic environment, coupled with favourable monetary policies from the European Central Bank (ECB), supported market sentiment. However, concerns over potential slowdown in global trade and the ripple effects of tariffs from the U.S. dampened investor enthusiasm to some extent.

Japanese equities again benefitted from the weakness of the dollar which helped inflate translated USD returns from the market. The market remains largely driven by the recovery in the economy and hope for large wage increases through 2025. Also, companies continue to deliver on their promises for good governance and shareholder friendly returns of capital to shareholders

Chart 2: High volatility in the S&P500 Index through April

Source: Bloomberg

Emerging market returns were good but were largely dependent on India and Brazil for positive returns. China’s previous rally faded somewhat as the two countries dialled up their tariffs and reciprocal tariffs.

Global equity returns remain relatively flat for the year-to-date. It’s the US vs. the rest of the world!

Table 1: Equity Market total returns in April 2025 (USD)

Source: Bloomberg

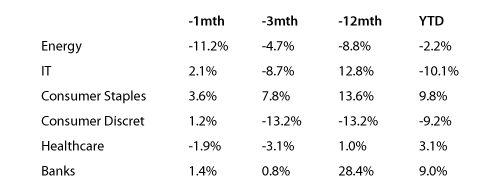

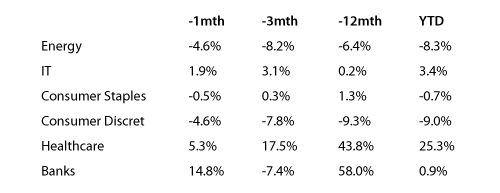

Equity sector performance

By sector, the energy sector was the standout falling 11% on the month. Investors’ concerns about the outlook for global growth led to a 19% slide in the oil price (WTI) over the month. IT rebounded somewhat from its recent bout of weakness.

Table 2: Global equity sector returns in April 2025

Source: Bloomberg

Bond markets

As confidence built that inflation was coming down and central banks delivered on rate cuts, bonds rallied. This translated into more of a general drop in yields rather than any significant performance from the credit market. Credit spreads remain essentially unchanged.

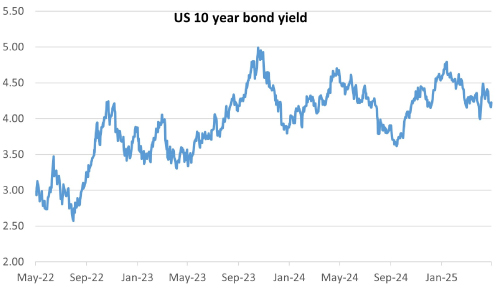

Chart 3 US 10-year Bond Yield in mid range

Source: Bloomberg

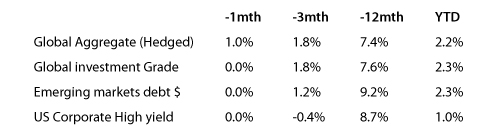

Table 3: Bond market returns In April 2025

Source: Bloomberg

FX and Precious metals

The feature of the month was the sharp rally in the Yen. Ongoing geopolitical issues, particularly in the Middle East, have led to a further rise in gold and bitcoin. Increased expectations of lower US rates reinforced the rise in the gold price and, as we saw in July, a weaker dollar.

Table 4: Monthly performance of precious metals and currencies for April 2025

Source: Bloomberg