Feb 21, 2023

• US core inflation is re-accelerating

• Fed will have to work harder to slow growth

• Longer dated US government bonds closer to fair value – but only if year-end inflation forecasts are correct

• The market has been very poor at forecasting inflation

• Equity markets have downside risk

If there ever was a salutary lesson to be learnt from not basing an investment strategy on one economic data, it would be what we are seeing at present. The markets’ reaction last month to the December inflation report that showed a slight month-on-month drop in inflation and a marked decline in the annual rate was rather upbeat. In the subsequent days, the US 10-year government bond yield dropped to around 3.35% from 3.60%. However, there was a bit of a reality check for the markets last week when the previous month’s “encouraging” month-on-month inflation number was quietly revised up to +0.1% from -0.1%.

Unlike what many had thought, the revision showed that US core inflation is no longer on the comfortable downward trajectory. JP Morgan pointed out late last week that the path of US CPI is very different from what the market previously assumed. As the charts below show, US core inflation is now thought to be accelerating after the upward revisions to the November and December numbers and the January data point, which cooled slightly but not as much as expectations.

After January’s inflation report the US 10-year is inching towards 3.90%. Also, it is worth noting here that the 6-month treasury has already hit 5.0%.

The higher yields in the bond market have attracted some strong inflows into bond funds. In January there were $26 bn of flows into high grade bond ETFs, well above the average of $17 bn per month in 2022.

At this point, investors shouldn’t bet strongly on any particular peak in the US Fed funds rate because the situation remains very fluid. If we go back to August/September last year, the market was pricing a cut in the policy rate after what it assumed to a peak in rates of 3.25%. Barely five months later, the market is now pricing a peak of 5.25%, and, as mentioned last week, there is an increasing market positioning for a 6% peak in rates.

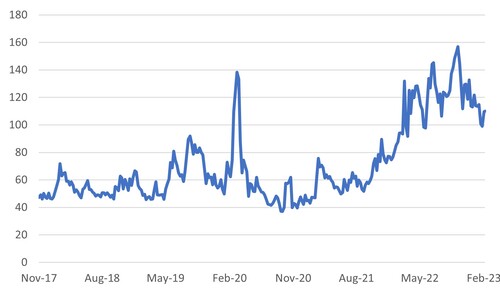

To make a big commitment to buying bonds, one needs to convince oneself that the level of yields is providing sufficient return for the risks that still lurk. When an asset is volatile investors typically eye greater return. Chart 1 shows us that the volatility in bonds (as a measure of risk) is down from the peak in the fourth quarter of last year but remains elevated relative to history. The MOVE index, a measure of bond volatility, is still at a level of 110, compared with the average of 55 seen between 2017 and 2021.

Chart 1: MOVE Index of bond volatility down from its peak but still high

Source: Bloomberg,

One pragmatic way to look at the valuation of the bond market is to analyse the level of real yields. Chart 2 shows the real level of the Fed funds rate and the real US 10-year bond yield. Each data series is adjusted for the level of US consumer price inflation.

A few points to note:

1. Both the real fed funds rate and US 10-year yield are still negative. Neither interest rates yet compensate investors for inflation. A real level of -2% is towards the lower end of the historical range.

2. The real 10-year bond yield is still an extraordinary 50bps below the real fed funds rate. Typically, real US 10-year yields are 100-200 bps above the real fed funds rate.

3. The Bloomberg consensus forecast for Q2 US inflation is approximately 4%. If we believe that forecast and try to solve for where the 10-year might be, historically, one might expect a yield of 100bps above the inflation rate and hence a 10-year yield of 5% would seem more plausible, and not the 4% that we see today.

For the current 3.8% US 10-year yield to offer ‘value’ would require the inflation rate to move back below 3% by the end of the year. The consensus so far is that inflation will indeed be at or around 3% by the end of the year. But the consensus has often been wrong, and too optimistic.

Chart 2: Real Fed funds rate and real US 10-year government bond yield still low by historical standards

Source: Bloomberg,

We would conclude that the US 10-year yield is priced around fair value, but our analysis is only based on the assumption that the consensus forecast for US inflation is correct. However, there is little risk premium in yields for the wrong consensus. Over the past 12 months, the consensus forecasts for inflation have fallen way off the mark.

As an indication of more pipeline inflation ahead, Nestle, the world’s biggest food group, commented that it still needed to be done on raising prices to offset some of the increases in input prices it has not been able to pass on to consumers. While it promised not to lift prices as aggressively as it did in 2022, it did warn that consumers would have to absorb a further round of price increases. Food and beverage companies have admitted that they have been forced to raise prices even at the cost of market share. It is worth noting here that last week’s US producer price inflation was markedly ahead of expectations. US producer price inflation ex-food and energy hit 5.4% against the consensus estimate of 4.9%. Clearly, companies may be facing an accelerating rise in input prices, which is alarming.