Jan 24, 2023

• Investors can become overconfident and spend too much time trading equities versus cash

• 2022 was a salutory lesson that the returns from active trading can be modest even if you get each call right

• Traders will have noted that both the US equity and bond markets hit a technical resistance last week at the 200 day moving average

• Gating alternative strategies by KKR and Blackstone don’t always reflect well on the fund management industry

Last week was another week of commotion in the markets. A few days of negative returns had commentators talking about the downside risks before a better Friday showing from Wall Street had all the bullish comments hitting the wires again. As we have stressed upon all along, there are easier bets to take than just worrying about the level of equities. Asia performed well again last week and looks likely to continuing doing so aided by robust data, China re-opening, and reduced concerns about a significant tightening of monetary policies.

We would again advise investors against getting too involved in trying to time the markets. Investors seem to be lost in a sea of technical trading and as last year showed, trying to be cute about positioning in either cash or equities can be damaging to performance. Our final comment this week looks at the controversy around some of the gating by major asset managers. Liquidity concerns is becoming a theme of the alternatives asset classes. Its not time to panic but it is important to be cognisant of what is going on.

200-day moving averages technically in play

The US equity and bond markets hit their resistance levels at the 200-day moving average in the past week. The US 10-year bond yield fell to a recent low of 3.32%, almost close to the 200-day moving average, before rebounding to 3.43%. The S&P500 market touched 3999, briefly crossing the 200-day moving average of 3981 before falling back. We suspect that the weaker economic data and a poorer outlook for corporate profits could, in the near term, see the S&P500 re-test the October low of 3577, roughly 8% lower than the current levels.

Switch between equities and cash: A tactical tail chasing

One of the favourite tactical calls that investors spend a great deal of time and risk their budget on is switching between equities and bonds/cash. The switch has been a favourite of many asset allocators, but it has remained one of the most dangerous, too. In 2022, investors had an apparent slam-dunk opportunity to add value by selling equities right at the start of the year and maintaining that position for the entire year. The S&P500 fell 19.4% on the year. However, the devil is in the detail. We doubt that many investors sold equities right at the start of the year. It is more likely they sold after February 24th when Russia’s invasion of Ukraine started. By February 24th, nearly half of the potential profit on a short equity position had materialised, with the market already down 10%. Instead of selling ‘late’, investors had to sit through the balance of the year digesting widely diverse commentaries on inflation and central bank policies, possibly struggling to maintain their conviction to hold onto the equity underweight and all for a modest return of 9.4% (less costs).

Below we have analysed the tactical opportunities that could have generated additional returns from switching between equities and cash in 2022.

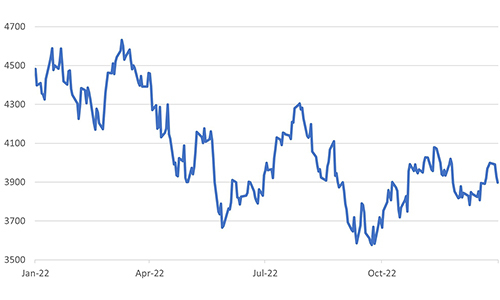

Chart 1: S&P500 trading range

Source: Bloomberg

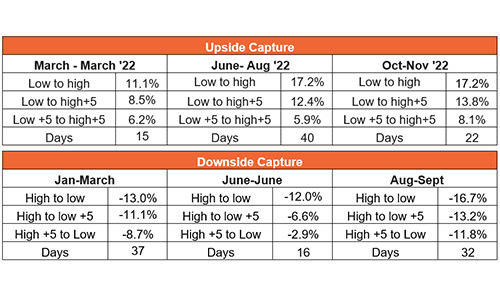

A buy-low-sell-high strategy had three distinct opportunities. However, each was of very short duration (between 15 and 40 trading day holdings). If you were five days late in selling at the top of the market and buying at the bottom of the market cycle, the returns become much more marginal at an average of 6.7% (before costs).

On the surface, a sell-high, buy-low strategy had a double-digit profit opportunity; however, practically speaking, the average return adjusted for likely delays in trading comes down to just 8%.

Table 1: Returns from trading the top to bottom ranges for the S&P500 in 2022

Source: Bloomberg

Note: Low +5 equals the level of the index five days after the low, High +5 equals the level of the index 5 days after the high of the index

What strikes us is that these were holding periods were quite short for any of the opportunities to truly materialise. For mainstream asset managers, the opportunities were rather fleeting. Tactical asset allocation outside of hedge funds tends to move much slowly as it eyes medium-term opportunities. Looking retrospectively and through the lens of a strategy that aims to rake in good return over a three-month holding period, the only significantly profitable trade could have been to sell equities at the end of March at the market high and buy back at the end of June. However, it was a struggle to be convinced that such a timing of making a switch was ideal. At the March high, markets were a bit optimistic that a ceasefire might take hold. At the June low, investors were quite concerned with the spike in inflation and the quickening pace of monetary tightening. Heightened volatility can give the illusion of an opportunity to make money, but volatility equals risk as much as it signals opportunity. In 2022, the VIX Index, a measure of market volatility, rose to 25 from a 100-day moving average of around 20, spiking up to 35. The opportunities to trade equities only look apparent after the event has unfolded. The pitfall of volatility is unpredictability.

The challenges of gating in alternative assets

KKR & Co. was another high-profile asset manager to place curbs on fund withdrawals last week. The New York-based KKR introduced a gate on its Real Estate Select Trust fund after it received redemption requests amounting to 8.1% of the fund’s value, exceeding the quarterly limit of 5.0%. The lack of flexibility on part of the asset manager was somewhat unprecedented, given that KKR admitted earlier that it had liquid holdings of 36% of their NAV. Also, the fund had subscriptions of $947 million last year.

KKR follows Blackstone in announcing curbs on withdrawals, prompting an SEC investigation. The involvement of the regulators underscores the seriousness of the concerns that market commentators have often had since the financial crisis: whilst the regulatory interventions have made the banking industry safe, some of the inherent risks in the economy have now shifted to the fund management industry. From the banks that were too big to fail, the narrative has now shifted to funds/fund management groups that are too big to fail.

Similar to a bank run when panicked depositors scramble to withdraw their cash from a bank facing liquidity problems, a run on the fund resembles a situation when jittery investors panic about gating and pull their cash from funds that could gate.Then, as they struggle with no money coming back from funds that gate against them, they rush to offload their holdings in other funds to build up their liquidity. The dash for cash then leads to market dysfunction and a drop in asset prices.

There are few signs of a liquidity panic as yet. Still, the regulator should be concerned with the potentially light-touch framework wrapped around the shadow banking industry, embedded now in the fund management industry. If the SEC and others start to impose new regulations on who can invest in funds of more illiquid assets, or they impose stricter liquidity buffers in funds that hold illiquid assets, it could set off a series of panic redemptions and lower long-term returns.