Feb 8, 2023

• Global market momentum continued in January as markets expect the rate hike cycle to end soon.

• The disconnect between central bank actions and market reactions exposes it to negative surprises.

• India’s union budget was balanced and prudent, and builds on past development agendas.

• We remain neutral on equities and await Q4FY22 earnings before revisiting our view.

• Domestic bond yields are attractive, and investors should lock in at current levels.

Optimism Rules

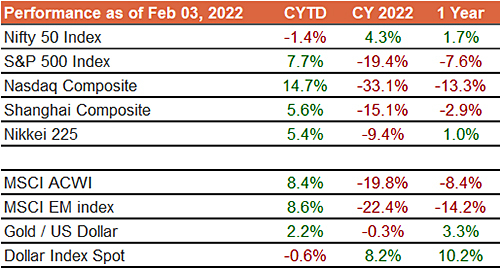

The positive trend observed in the last quarter of 2022 has persisted into the new year. Despite central banks (Fed, ECB, BOE) raising interest rates to new 14-year highs and maintaining a restrictive stance, the market has responded optimistically, as they believe the end of a sharp rate-hike cycle may be near. As a result, global equity markets have seen gains of 5-10% across geographies.

As noted in our previous commentary, the disparity in performance between India and the rest of the world observed in 2022 may reverse in 2023, which has proven to be the case with India being among the few markets that have seen a decline this year.

Source: Bloomberg, Sanctum Wealth

All data are in local currency and are price returns.

Global Market Update

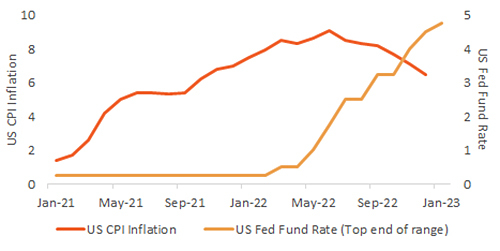

The Federal Reserve’s recent monetary policy decision confirmed market speculation that the pace of interest rate hikes would be slowing. Despite this, Fed Chair Powell emphasized that the central bank’s job is not yet complete and financial conditions will remain tight until the target inflation rate of 2% is achieved. The Fed recognizes that disinflationary pressures have begun but acknowledges that elevated inflation persists in many parts of the economy. The tight labour market remains a concern and the Fed believes that inflation will not be contained within its target range without a more balanced labour market.

US inflation has started declining but is still above Fed’s 2% target

Source: Bloomberg, Sanctum Wealth

In the Eurozone, the economy avoided recession, with a 0.1% growth in GDP in the final quarter of 2022, although core inflation remained above 5%. The European Central Bank raised interest rates by 50 bps indicated another 50bps hike in March. The Chinese economy is also recovering aided by policy stimulus and reopening, and the official manufacturing PMI entered expansionary territory (above 50).

China PMI back in expansionary territory

Source: NBS, Sanctum Wealth

The market appears to be anticipating a soft landing, where global central banks would succeed in cooling inflation without causing a severe recession. But a Fed pivot (change in Fed policy) and a soft landing are contradictory as the Fed will pivot only if growth falls substantially. Central banks appear determined to avoid doing too little rather than too much. This may make markets susceptible to negative surprises in the coming months.

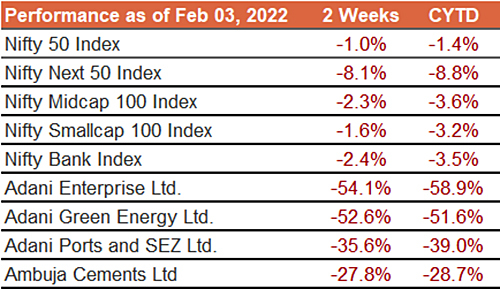

Indian Market Update

Recent developments in India have been dominated by the significant decline of the shares of Adani group companies, post the Hindenburg report. Despite the extensive coverage of this matter, it is important to note that the systemic risk to the Indian markets from this situation appears to be limited. The Indian banking sector’s exposure to Adani group entities is diversified, and no single bank appears to be excessively exposed. At a systemic level, the debt is estimated to represent 0.6% of total loans outstanding and less than 5% of equity. Additionally, domestic mutual funds have limited exposure, in terms of equity and debt. However, short-term sentiment may be impacted.

Source: Bloomberg, Sanctum Wealth

Above returns are total returns

Another noteworthy event last week was the presentation of the union budget for FY2024. In recent budgets, the government has sought to keep major reforms outside the budget and has aimed to maintain continuity. Given that this was the final full-year budget prior to the 2024 general elections, there were some concerns that it may have a populist bias. However, the government displayed restraint and delivered a balanced and prudent budget that did not include any significant negative surprises.

The latest budget builds on the following themes, which were also observed in previous years:

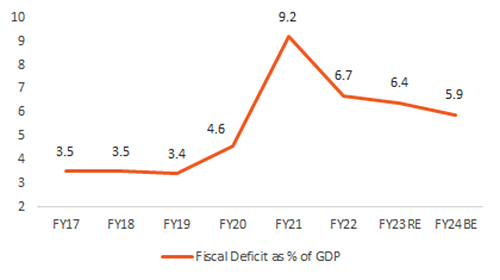

1. Fiscal Responsibility

Despite the trend of governments worldwide loosening their fiscal policies during the COVID-19 pandemic, the Indian government maintained a prudent approach. Additionally, it used the opportunity to improve the transparency of its fiscal calculations, thereby enhancing its credibility. Despite the upcoming general election, the government remains committed to its path of fiscal consolidation, with a targeted fiscal deficit of 5.9% for FY24 and gross and net borrowing within the expected range. The projected nominal GDP growth of 10.5% for FY24 is slightly optimistic but achievable, and the assumed tax buoyancy and disinvestment targets are reasonable.

Fiscal deficit on a consolidation path

Source: NBS, Sanctum Wealth

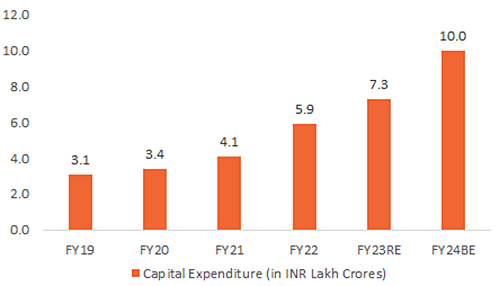

2. Capital Expenditure Boost

The government has been emphasizing increasing capital expenditures in recent budgets to build infrastructure, and the latest budget takes this further by allocating a record-high INR 10 lakh crores for capex, more than double the FY21 allocation. This has been possible due to moderate revenue expenditure growth thanks to a post-COVID normalization. Infrastructure-focused sectors such as railways and roads remain key priorities. The increase in capex is expected to drive growth, given the multiplier effect, especially when the rest of the world is slowing.

Capital expenditure has doubled in the last three years

Source: NBS, Sanctum Wealth

3. Tax Simplification and Compliance

Simplifying personal income tax and reducing tax arbitrage opportunities have been key themes in previous budgets, and the latest one continues this trend. This budget introduces incentives for adopting the new personal income tax regime and reduces surcharges for the highest tax bracket. However, these savings could be offset by measures to prevent tax arbitrage, such as changes in capital gains tax on market-linked debentures, capping capital gains rollovers on residential property to INR 10crs, higher TCS on LRS transactions, and tax on insurance policies with premium above INR 5 lakhs.

The cap on capital gains rollovers for residential property may affect high-end real estate sales but may also drive financialization as those funds get redirected to financial markets. Separately, the change in the taxation of certain insurance policies will impact the insurance sector as a part of the growth seen over the last two years was on the back of these types of policies. Hence, insurance sector stocks corrected sharply post the budget.

4. Inclusive and sustainable development

The budget continues to focus on areas such as housing, skill development, MSMEs, sustainable growth, and digitalization. It increased the allocation to affordable housing to INR 79,000crs, a 66% YoY increase. Additionally, various measures for skill development like setting-up centres of excellence, the skill India digital platform, the national digital library, and new nursing colleges were announced. An increased allocation to the MSME industry, revamping the credit guarantee scheme, relief for failed contracts during covid, and entity DigiLocker for MSMEs were some measures to support this industry. India has been at the forefront of the global climate change initiative. The focus on green growth and increased allocation towards it, as custom duty reduction on imports by EV battery manufacturers, are steps to support sustainable development.

Overall, it is a budget that continues to build on many of the themes the government has emphasised over the past few years.

Asset Class Views

Indian Equities

As expected, the recent economic data in India has moderated sequentially as indicated by the January PMIs. The services PMI moderated to 57.2 from 58.5, while the manufacturing PMI went to 55.4 from 57.8. Despite this, the data remains strong compared to the global context, and the budget continues to support growth. We believe India’s economy could remain resilient despite a global growth slowdown.

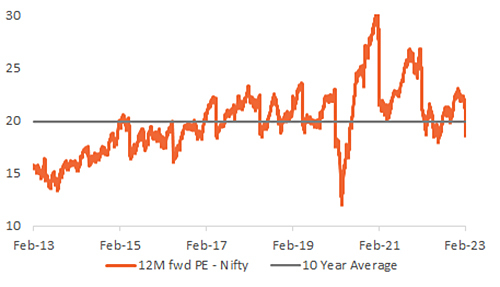

With the recent correction, valuations of Indian equities are now closer to historic averages. Even relative to other emerging markets, India’s premium has reduced since emerging markets have rallied while India has not. The focus will now shift to the upcoming earnings seasons, and it could provide triggers for further market movements. We remain neutral on equities for now and will revisit our call after the earnings season.

Valuations are close to historic averages

Source: Bloomberg, Sanctum Wealth

Indian Fixed Income

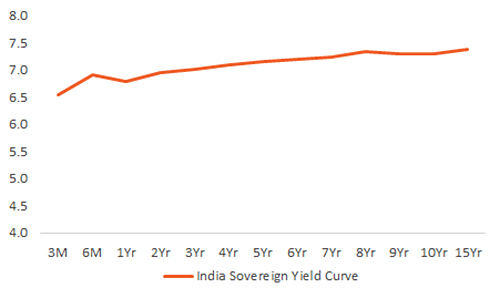

With the government sticking to its fiscal consolidation path and reasonable assumptions for FY24 fiscal calculations, bond markets reacted positively, with the 10-year benchmark yields declining post-budget. It is important to note that while the net borrowing was in line with expectations, at an absolute level it is still significant. Additionally, high levels of SLRs and credit growth could impact demand by banks. A conducive environment for Indian fixed income largely offsets this as we approach the end of the rate hike cycle in India and look forward to a possible rate cut towards the end of this year or early next year.

Overall, we believe yields have peaked and investors should lock in at current levels. The yield curve is very flat, and we expect it to bull-steepen (short-term yields likely to fall more than long-term yields). Target maturity funds, thus, remain a preferred strategy. We also believe it is time to start adding some duration to the portfolio over the next few months.

The yield curve is likely to steepen

Source: Bloomberg, Sanctum Wealth

REITs and INVITs

REITs and INVITs primarily distribute income in the form of interest, dividends, and income from other sources. The last component will now be taxed at the marginal tax rate in the hands of unit holders, where it was previously not taxed. This impacts the post-tax yield for some of the listed REITs and INVITs, and the prices of these will now re-align with the updated post-tax yield.

Given attractive bond yields, we had suggested investors move money from REITs and INVITs back to debt mutual funds a few months back. However, we liked Embassy REIT given the attractive price, high- quality portfolio, expectation of a rise in occupancy and expected growth from the hotel business. However, a significant portion of Embassy’s distribution comes from ’amortization of SPV level debt‘ which is now taxed. Hence, we have exited the same in our model portfolios.