Dec 5, 2022

• Market is pricing the dream that interest rates will peak at a reasonable level and fall back quickly in the second half of 2023.

• More likely that rates will peak and stay a high level for much of 2023

• Slack will have to be created in the global economy which puts corporate earnings forecasts at risk

• The dollar falls back but gold’s 10% rise compensates

• China’s authorities step up an easing of COVID restrictions

The performance of markets in November and the early days of December reflects the hope that good news is just around the corner. The markets prefer to ignore the economic data that shows the global economy is in a significant downshift in growth and facing prolonged high-interest rates. The markets prefer to discount the hope that interest rates will peak soon, and central banks will apply themselves to loosening monetary policy, and growth will resume…. Dream on.

The market was holding its breath ahead of Fed Chairman Powell’s speech last week. In the event, the market decided to interpret what he said as evidence that the Fed was willing to slow the pace of tightening and move quickly to a pause in rate hikes. Chair Powell’s “Fed speak’ has not changed the fact that the Fed is concerned that interest rates are still a long way short of a level that would ordinarily bring down interest rates.

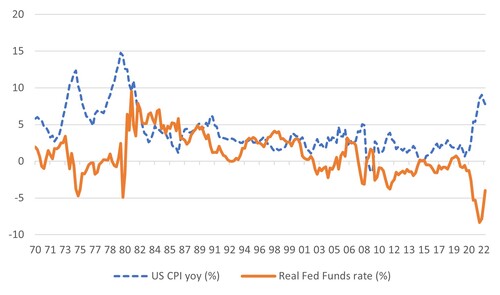

Global inflation may have peaked, but there is little comfort for central bankers that inflation will reach its targets anytime soon. In the US, the real fed funds rate remains well below the rate of inflation. Central banks usually only tame inflation when policy interest rates are above the inflation rate. As we have persistently argued, it is wishful thinking that central banks can tame inflation with a few rate increases that do not create slack in the economy. The US economy remains at full employment. The unemployment rate is at a 30-year low of 3.7%. The lack of slack in the labour market is pushing wages higher; last week’s US labour report showed average hourly wage earnings growing at 5.1% – a significant surprise to the upside versus market expectations.

Chart 1: Real interest rates remain very low relative to history

Source: Bloomberg

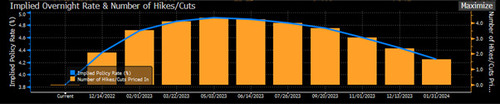

We believe the Fed’s comments have been fairly consistent of late, expressing the view that rates will move much higher and stay at that level for longer. The market begs to differ. By the end of last week, the market was pricing that the Fed funds rate would peak below 5% and that policy rates would be on their way down through the second half of 2023 (Chart 2). By contrast, policy rates in the eurozone are expected to peak in the middle of next year at 2.8% but stay there for the balance of the year.

Chart 2: Market pricing of Fed Funds rate – peaking below 5% and sliding through 2H23

Source: Bloomberg

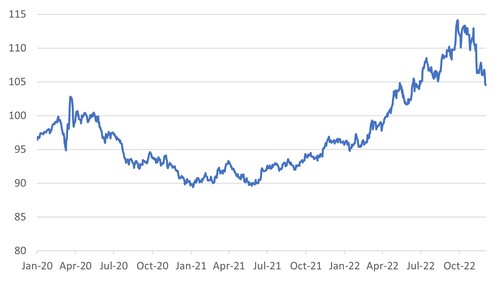

Hence the dollar has come under further profit taking with the euro gain two cents in just three trading sessions at the end of the last week. On a trade-weighted basis the dollar has, in essence, unwound most of the extraordinary gains through the early summer months.

Chart 3: US Trade weighted index corrects the phase of dollar exuberance

Source: Bloomberg

A sharp rise in the gold price has accompanied profit-taking in the dollar.The gold price is up 10% from its low of early November. We continue to believe that gold is a valuable asset in dollar cash management. Switching from dollar cash to gold at the peak of the dollar’s trade-weighted performance would have been a valuable source of added value – easier said in hindsight, but food for thought if we see any further spikes in the dollar in coming months.

Chart 4: Gold price rises to compensate for downside to US $ trade-weighted index

Source: Bloomberg

There are no short cuts, central banks will only conquer inflation if rises in interest rates dampens global economic activity. Recent business surveys are pointing to a sharp slowdown through November. J.P.Morgan’s global manufacturing output survey dropped to “a level rarely seen outside of a recession” the bank recently commented. Analysts’ US corporate profits forecasts rolled over in July and have been on a downward trajectory ever since. In November analysts cut their aggregate earnings for the S&P500 to a level marginally below where we started the year. In the next phase of the equity markets we expect to see to be a material fall in analysts’ earnings estimates. Investors should be preparing themselves for a 10-15% drop in profits in 2023 as a typical outcome during a slump in economic growth.

Chart 5: Expected level of S&P500 earnings for 2022

Rebased to Jan 22=100

Source: Bloomberg

Finally, we seem to be getting some consistent cracks in the anti-COVID regime in China. Shanghai has joined Beijing, Shenzhen and Guangzhou in relaxing some of the more draconian restrictions on the mobility of citizens. The relaxation is largely taking the form of the withdrawal of the mandatory COVID testing for anyone to go about their general activities. The Chinese markets should hold onto their recent gains – the Hang Seng China Enterprises Index was up 29% in November. The Hang Seng index was up 26.8%, the biggest monthly rise since 1998. The challenge will be to see how the authorities deal with the very likely sharp rise in COVID cases. For traders the Hang Seng index could rise a further 15% which would take us back to where we were at the end of the second quarter.