Nov 1, 2022

• Some hope in the market that central banks will start to be less aggressive with rate increases

• We believe there is scope for disappointment this week with the Fed and UK MPC likely to emphasise the need for further marked tightening.

• The REITs sector had reason to rebound and may still be good value over the longer term

Markets have had a good run recently, with both bonds and equities rallying from their recent lows. We had advocated last week that bonds could be a route back into the markets and we stand vindicated. The immediate 2% return in the past from the global aggregate index is a testimony to our tactical approach. The recent rally across asset classes, at least some of it certainly, has been due to the view in some parts of the market that central banks are about to slow the pace of monetary tightening. To add to it, some commentators have been bold enough to suggest that an economic soft landing is just round the corner. We remain sceptical, though. In our view, central banks may be moderating the pace of the rate increases, but they still have many more (smaller) such increases to implement before they believe that inflation in firmly under control.

This week central banks remain very much in focus as we await decisions from the Federal Reserve, the Bank of England, and the Reserve Bank of Australia.

Here, let us offer a framework for our thinking about central policy-making.

Stage 1: Regaining credibility

Most central banks were woefully slow in reacting to the growing threat of inflation. Caught off-guard initially, the banks had to raise rates rapidly to regain their credibility, which resulted in significant rate increases that we saw from many central banks.

Our view: This is where many central banks find themselves now. But this doesn’t mean they are comfortable that they have won the battle against inflation. In fact, far from it, inflation levels are quite elevated and way above the central bankers’ targets.

Stage 2: Keeping up the good work

Central banks reduce the incremental size of their rate hikes.

Our view: It may be comforting to the financial markets that the ‘shocking’ rate increases are behind us, but there is still scope for worry as central bankers may be forced to raise rates repeatedly. Even as the increase in core inflation worries many central banks, it will become an even uphill task if it spills over into wage inflation. The nature of the inflation data in the coming months will be crucial in determining whether central bankers will need to raise rates further.

Stage 3: Possibly pausing rate increases on hopes that inflation is under control

Central banks signal that they may skip raising rates for a meeting or two to see how the increase in policy rates affects the economy.

Our view: Undoubtedly this would be good news for the financial markets, as long as any central bank action makes the right call. However, we would caution investors to not mistake any signs of a drop in the level of inflation as a signal of all-clear for central banks to ease off from tightening. The persistence of core inflation will have more of a bearing of likely future tightening.

The market rally in the past two weeks reflects a hope that we are moving to stage 2. Central banks that earlier were way behind the curve in not raising policy rates anywhere near to the inflation rate are getting closer. However, we are still some quarters away from any major central bank feeling sufficiently confident to sound the all-clear.

Further central bank tightening on cards—but might it be less aggressive?

This week, the Federal Reserve will likely raise rates by 75bps to 4.0%. There are increasing hopes that Fed Chairman Jerome Powell will discuss a potential reduction in the size of future rate increases. At the close of the year and into the next, the market expects a drop in the pace of rate increases to 25-50bps increments in the subsequent meetings.

Current fed Funds rate 3.25%, inflation 8.2%

The Bank of England’s Monetary Policy Committee is expected to raise rates by 75bps, to 3.0% this week. There is an outside chance of a 50bps rise given the change in prime minister and the new government’s more austere spending plans. However, an inflation rate of 10.1% will undoubtedly influence the committee’s decision.

Current BoE policy rate 2.25%, and inflation 10.1%

The European Commercial Bank (ECB), as expected, raised the policy rates by 75bps last week to 1.5%. However, it later emerged that the decision wasn’t unanimous, with three voting members calling for a 50bps rate increase. Also, the statement from the bank removed the previous commitment to raise rates over “several meetings”. The nature and scale of quantitative tightening have still not been communicated to the market. However, the ECB will deliberate on the policy at its next meeting.

Current ECB rate 1.5%, and inflation 9.9%

The Reserve Bank of Australia (RBA) and the Bank of Canada both tempered the pace of their rate hikes at their last meetings, implementing policy rate increases below the market’s expectations. Both central banks are expected to continue to raise rates but probably in increments of 25bps. This week the RBA policy meeting will likely raise the rates to 2.85%, with inflation last reported at 7.3%.

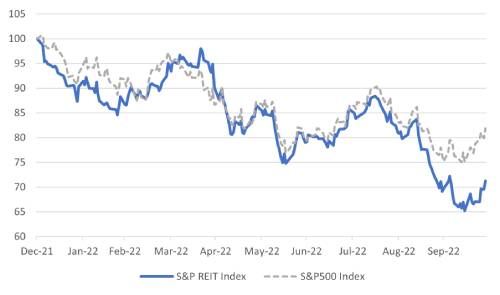

US REITs—long-term value

The US REIT sector was one of the interest rate sectors with some exaggerated downside as interest rates rose. Despite rallying 10% from its lows, the sector is still down almost 30% from its year high. We believe US REITs continue to offer long-term value. The sector’s credentials are further helped by ongoing strong dividend growth. Hoya Capital research estimate that the number of REIT dividend increases this year is 120, a new record. Over two-thirds of REITs have raised their outlook this quarter, much better than the broad market at less than 50%. While we still recognise tough times ahead, the sector will negotiate those challenges, if at all, from a strong starting point. As we are seeing, rising interest rates are proving helpful to the single and multi-family rental sectors. Near 7% mortgage rates make buying a property a much more challenging proposition; hence, higher interest rates are only increasing rents. Stronger rental demand is still meeting minimal supply growth.

Chart 1: US S&P REIT Sector Underperforms S&P500

Chart is rebased to December 31st 2022=100

Source: Bloomberg