Citywireasia, Oct 5, 2020

HSBC Private Banking’s Virginia Devereux Wong and Sanctum Wealth Management’s Roopali Prabhu discuss female representation in fund management.

This month Citywire released its 2020 Alpha Female Report that drew on an exclusive database of 16,000 fund managers.

The overall percentage of female managers in the database has crept from 10.3% in 2016 to 11% this year. Still, the industry will only achieve gender parity in 2215, if the current rate of progress persists.

The good news? Asia leads the way on female representation as compared to other regions, led by Hong Kong (27%), Taiwan (19%) and Singapore (17%).

Female managers pull their weight on performance too. Goldman Sachs recently analysed 496 largecap US equity funds and found that all-women and mixed-gender portfolio management teams had outperformed all-male teams so far this year.

Two fund selectors share their views of female representation in fund management.

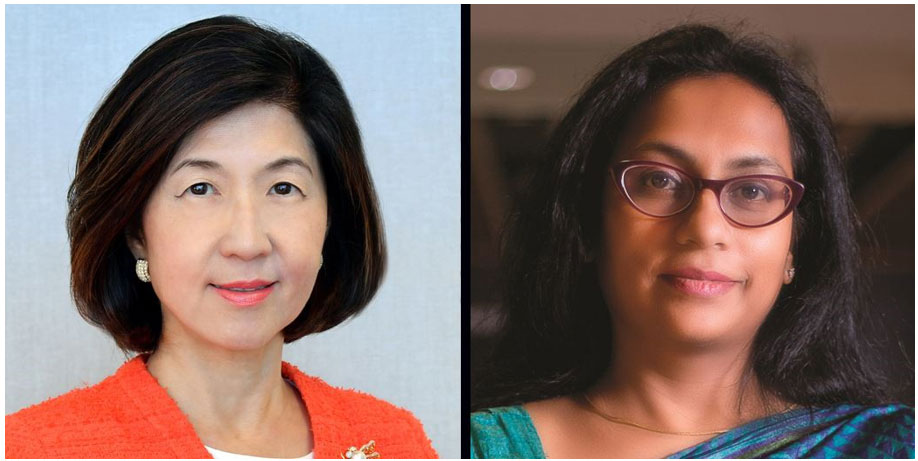

Roopali Prabhu (pictured, right)

Sanctum Wealth Management

Head of investment products

Females – particularly in Indian fund management industry – are scarce, observed Prabhu.

This is despite banking and finance being considered one of the most suitable fields for women, who joined the corporate workforce in sizeable numbers decades ago.

‘We see wider representation of women in the relationship management side of wealth management.

‘But in the investment and product management domain, even at the time of hiring we rarely see women candidature.

‘In fact, I can count on my fingertips the number of women fund managers I have come across in the past decade,’ she said. Prabhu could not specifically pinpoint takeaways that are attributable to gender factors in her interactions with female managers.

‘Most of them are just good managers, with the required discipline and balanced, analytical approach that is also common to the larger universe of fund managers. Most of them articulate, few not so much.

‘It’s interesting though, that as I reflect, almost all these women fund managers passed through our qualitative selection filters,’ she said.

Virginia Devereux Wong (pictured, left)

HSBC Private Banking

Asia head of funds and ETFs for Asia

In the pre-Covid era, most fund managers would be invited to give townhall presentations and conduct meetings in person. For HSBC, meetings have been held virtually and webinars have become an acceptable way of communication since early March.

‘We have not noticed any difference between male or female fund managers in terms of treatment or airtime. We only focus on the investment content and not on the gender difference,’ Wong said.

‘In general, we see an increasing number of fund houses promoting female senior executives, equity partners and head of business developments.

‘The works of women’s to promote financial women’s profiles in the market, and women mentoring programmes in the industry certainly help to reduce gender inequality,’ she added.

Wong does not see a correlation between gender difference and performance. HSBC’s funds platform is purely a result of qualitative and quantitative evaluation of the products, she said.

‘We do not consider the gender of the fund manager as part of our fund selection process.’