livemint, Mar 12, 2021

Prateek Pant

As more people return to offices, occupancy levels of Reits will pick up

Over the past few years, bond yields have declined sharply as the markets continue to be flush with liquidity as central banks print money. After several years, Indian investors are contending with negative real rates (interest rates < inflation). While bond yields have rebounded over the past few months, commentaries by most central banks suggest that low interest rates are here to stay.

As equity markets create new highs, many investors looking to rebalance their portfolios are struggling to find suitable options to increase yield on their debt portfolios without taking significant credit risk. Additionally, some investors are seeking instruments other than corporate fixed deposits that can offer regular income.

In this context, real estate investment trusts (Reits) offer an attractive alternative to debt for long-term investors.

Reits are investment vehicles that pool in money from unitholders to invest in real estate assets. The Reit issues units that are listed on the stock exchange and can be bought and sold on the exchange. Sebi mandates that 80% of the assets of every Reit be invested in operating and cash-flow generating assets and 90% of those cash flows be distributed to unitholders. Given these mandates, investors have visibility on a regular stream of income.

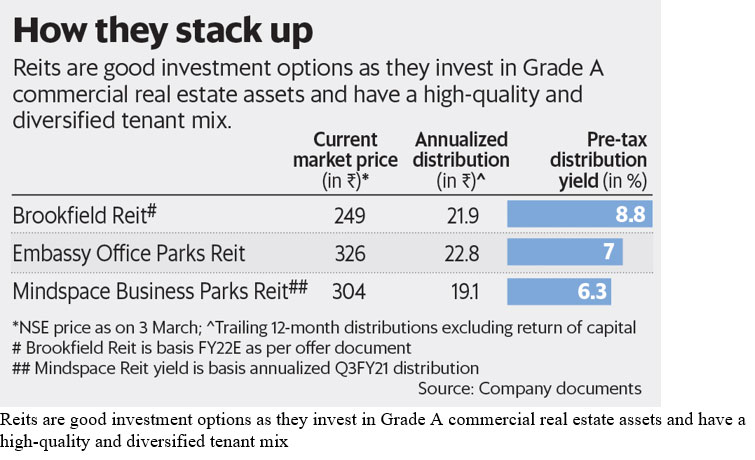

Currently, there are three listed Reits—Embassy Office Parks Reit (sponsored by Blackstone Group), Mindspace Business Parks Reit (sponsored by K Raheja Group) and Brookfield India Reit (sponsored by Brookfield Group).

All these Reits are good investment options, as they invest in Grade A commercial real estate assets, have a high-quality and diversified tenant mix, and are managed by highly experienced and well-known sponsors. While Embassy has a larger concentration of its portfolio in Bengaluru, Mindspace has most of its assets in Mumbai and Hyderabad, and Brookfield has a higher allocation to the Delhi NCR market.

We have seen some correction in Reit prices following a weak quarter of results by Embassy and Mindspace. While some decline in occupancy was expected, last quarter saw higher than estimated exits from the portfolio. A major investor concern is the work-from-home rhetoric. While we believe work from home is here to stay, it is unlikely to fully replace the need for office space. Going forward, many companies are rolling out a hybrid model providing flexibility to their employees. While this could impact demand for office space in the near term, as more and more people start returning to offices and firms start to re-lease office spaces, occupancy levels of these Reits would pick up.

Other factors that will drive demand in the coming few quarters include increased digitalization across sectors and the fact that India is likely to remain a preferred global outsourcing destination. This is clearly visible in the jump in hiring done by information technology (IT) firms. The top four IT giants in India—TCS, Infosys, Wipro and HCL—made a net addition of 36,000 employees in the December 2020 quarter against 10,820 in the quarter ended December 2019. Reports suggest that they plan to hire at least 91,000 additional employees in FY22 as well.

IT firms make up for more than half of the tenant base in each of the Reits. There is a strong possibility that IT firms may lease additional space vacated by the smaller tenants. Additionally, these Reits have very little exposure to some of the troubled sectors like hospitality, airlines, travel, etc.

Prateek Pant is head of product & solutions, Sanctum Wealth Management.