livemint, Apr 7, 2021

Prateek Pant

The bulk of the returns come from being in the right asset class as opposed to the right fund

There are very high chances that one would come across a debate between active and passive fund management when looking through blogs on personal finance. Such debates become even more pronounced when active managers across all styles underperform the benchmark, like in FY21.

The goal of an active manager is to outperform a market benchmark through the deeper analysis of stocks and bonds. Passively managed funds track a specific benchmark by replicating the holding to deliver benchmark-like returns. Active investing is generally more expensive as one needs to pay for the transaction costs of “active buying and selling". Additionally, one is paying for the skills of the fund management team.

Over the years, as the alpha produced by actively managed funds in the US has come down significantly, investors moved their money to low-cost passively managed funds. Currently, passively managed funds make up more than 50% of total mutual fund assets under management (AUM), compared to 20% of total AUM in 2010. We may see a similar trend in India. Currently, less than 10% of the mutual fund AUM is in passively managed funds.

However, even in India, the AUM of passively managed funds is growing at a much higher rate than actively managed funds.

So, are actively managed funds still relevant for Indians?

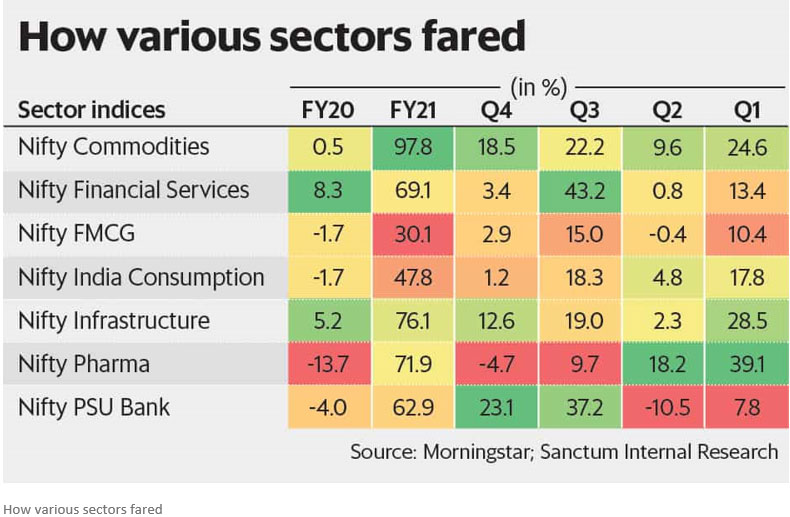

The past year saw a black swan event in the coronavirus pandemic, which caused major turmoil in the markets. The markets initially went through a capitulation, followed by an even sharper recovery. This was accompanied by quick sector rotation.Financial services, the favourite of most active managers, underperformed in Q1 and Q2 of FY21. The sector then bounced back sharply in Q3; by then, most managers had underweighted the sector. Pharmaceuticals, a sector that most fund managers were underweight in FY20, rallied hard in the first half of FY21 as the pandemic brought the industry into the spotlight. In the second half of FY21, as managers turned overweight on the sector, it underperformed. Commodities, a sector that active fund managers have underweight for a few years now, also rallied in FY21.

A more structural reason for the decline in the alpha of large-cap funds has been the recategorization of mutual funds by markets regulator Securities and Exchange Board of India (Sebi) in 2018, which created strict boundaries for what active managers could purchase.

These top 100 large-cap companies in which large-cap funds can invest the bulk of their monies have very little information asymmetry. Hence, large-cap funds will continue to find it difficult to outperform the benchmark after factoring in the expenses.

Midcap and small-cap funds have done well over longer periods of time. Since most of the stocks are under-researched, manager skills matter, thereby providing enough opportunities for outperformance. Actively managed multicap funds have struggled over the past two calendar years as markets were polarized in 2019 with very few large-cap stocks making up the bulk of the returns, followed by sector rotation in 2020. With a large universe to choose from and position the portfolio, we expect top-quality multicap managers to outperform over the long term.

While the universe for passive funds is large enough in the large-cap segment, there are very few small-cap, multicap and sectoral exchange-traded funds (ETFs) and index funds currently available to investors. Hence, active funds will continue to be relevant for small and midcap allocations.

To conclude, while we could keep debating active and passive, there have been enough documented studies which show that the bulk of returns come from being in the right asset class as opposed to being in the right fund.

Due to market volatility, we know of investors who sold all their equity holdings last year and are sitting on cash, waiting for the right time to deploy back in the market! Hence, the starting point would be to get the asset allocation right and create a portfolio using a combination of active and passive strategies.

Prateek Pant is co-founder and head of products and solutions, Sanctum Wealth Management Pvt. Ltd.